With effect from 23rd March 2020, the Ministry of Corporate Affairs has deployed the web form CAR (Company Affirmation of Readiness) towards COVID 19 in which the Company and LLPs shall file the compliance that they are in compliance with the COVID 19 guidelines along with the Work from Home policy.

Here are some Frequently Asked Questions regarding the form:-

Applicability of the form

The Form shall be applicable on the Indian Companies / Foreign Companies / Limited Liability Partnerships / Foreign Limited Liability Partnerships.

What is the MCA filing fee for the filing of form CAR

There is no fee for filing the form.

Who can file the Form CAR

Any authorised signatory can file the form

Whether DSC required in the case of filing of form

No DSC is required for filing the form. The same can be filed with the help of OTP

Whether any SRN is generated on filing of the Form

No SRN is generated on filing of the form. Only system based acknowledgement shall be sent to:-

– Email ID of the respective company / foreign company / LLPs or foreign LLPs

– Email ID of the Authorized signatory who is providing the affirmation

– Email ID of the FO user who is submitting the affirmation

Last date for filing the Form CAR

The form shall be filed from 23rd March 2020 onwards but not later than 30th March 2020.

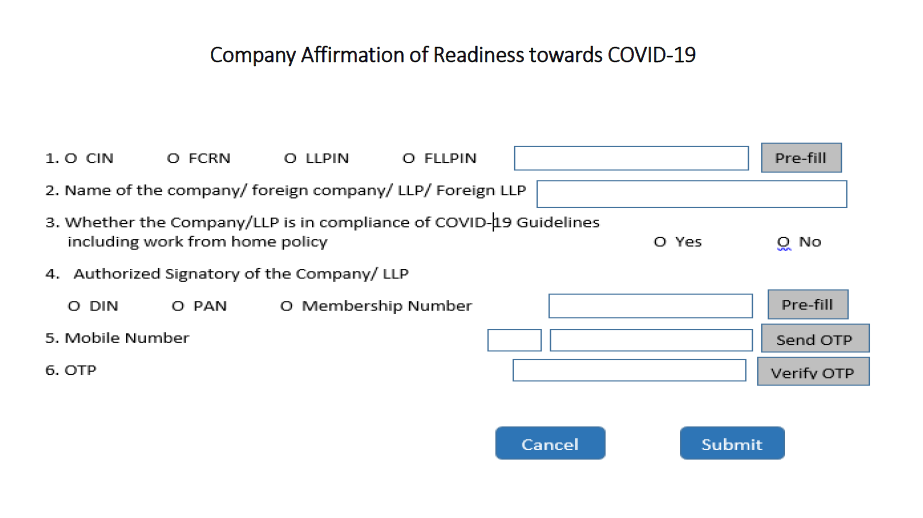

PROCESS OF FILING THE FORM CAR

Step 1 – Enter the CIN / FCRN / LLPIN / FLLPIN

Step 2 – Click on the pre-fill button

Step 3 – Select whether the Company / LLP is in compliance with the COVID 19 guidelines including work from home policy

Step 4 – Select the DIN / PAN / Membership number of the Company / LLP currently associated with the Company / LLPs. Please make sure that the valid DIN /PAN should be entered in case of Directors and Membership number in case of Company Secretary in full time employment. After entering the data, click on the Pre-fill button.

Step 5 – Enter the valid mobile number if it is not pre-filled (the field is editable) and click on the pre-fill button.

Step 6 – Enter the OTP received and click on ‘Verify button’

Step 7 – After the OTP is verified. Click on the Submit button.