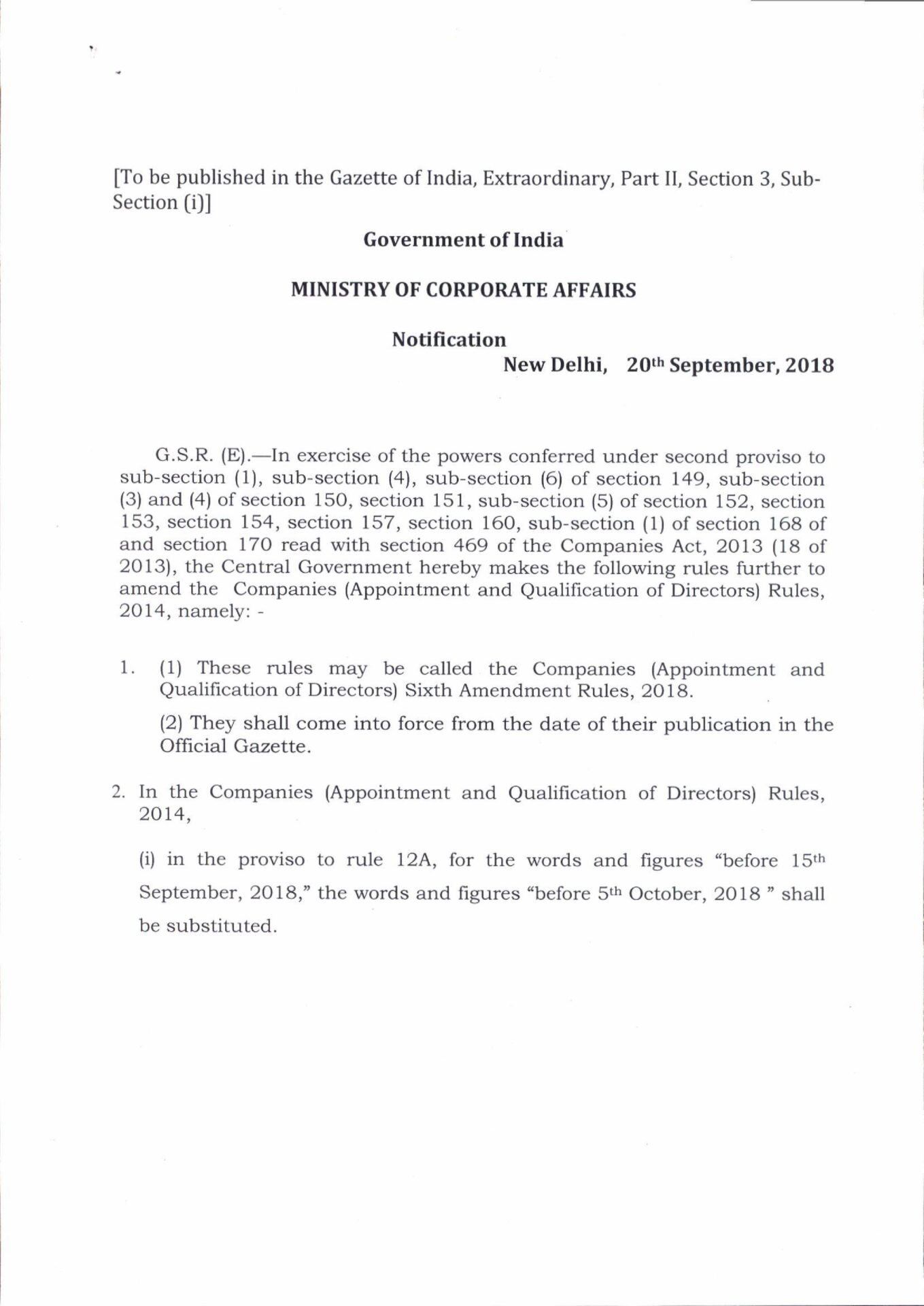

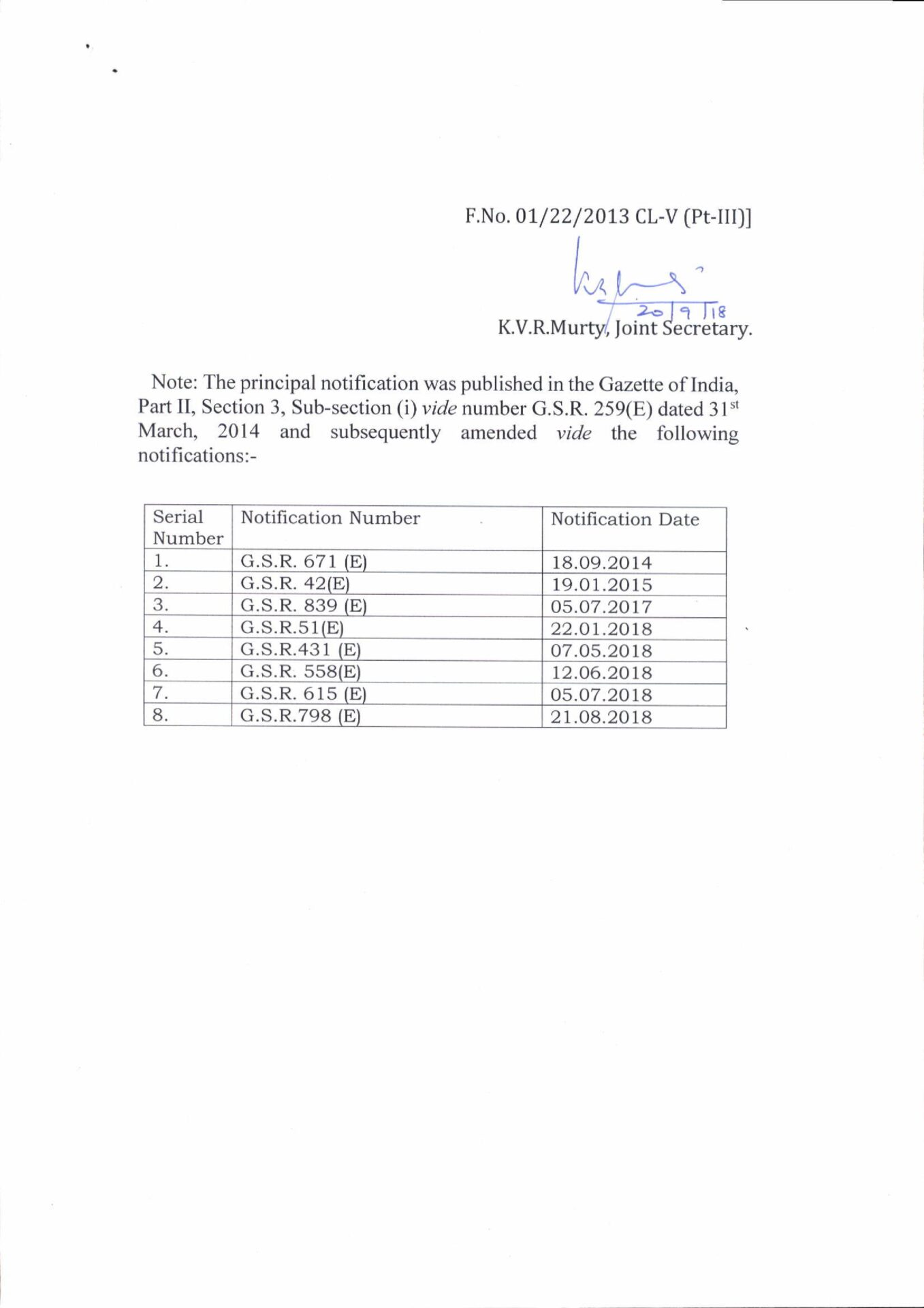

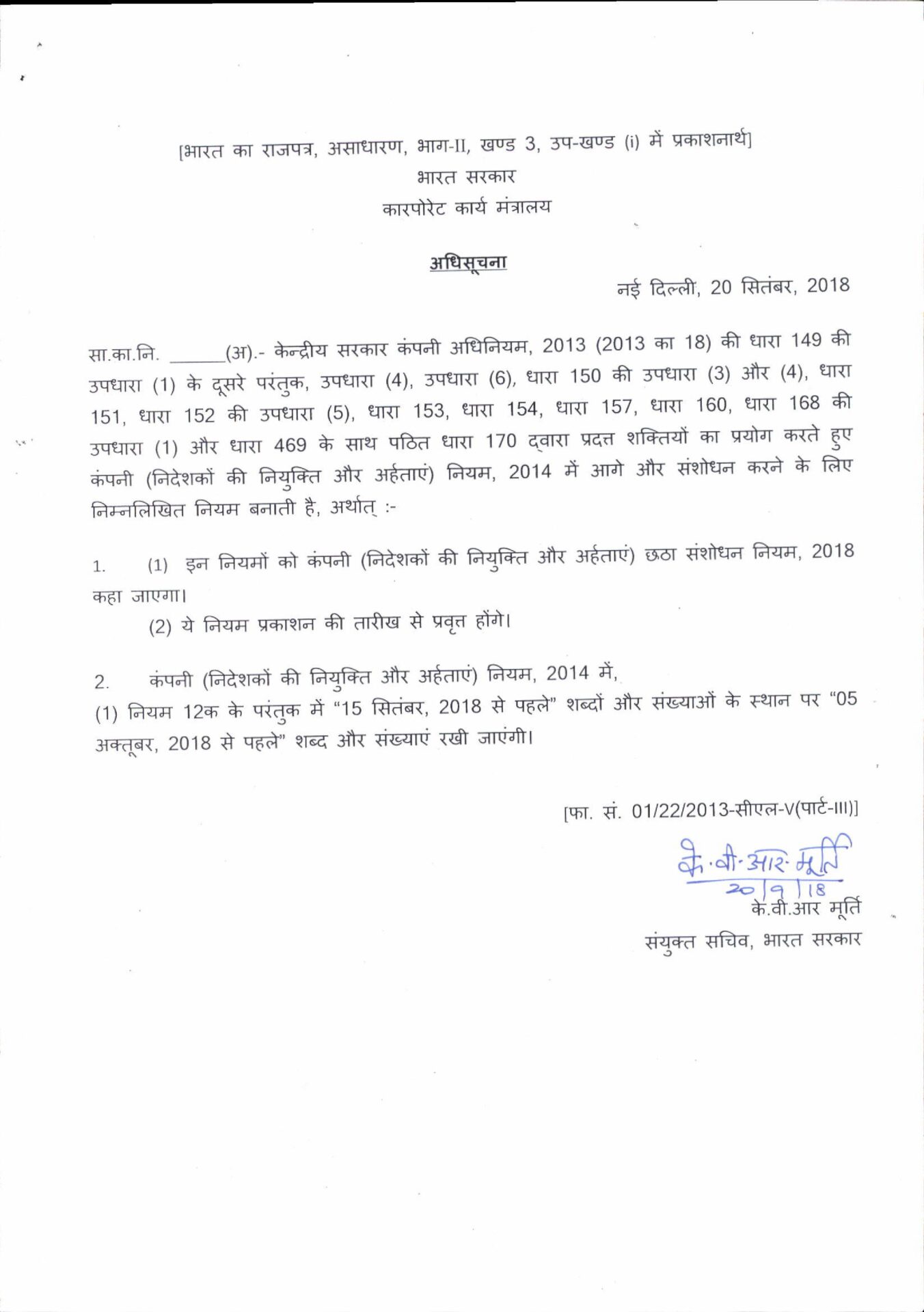

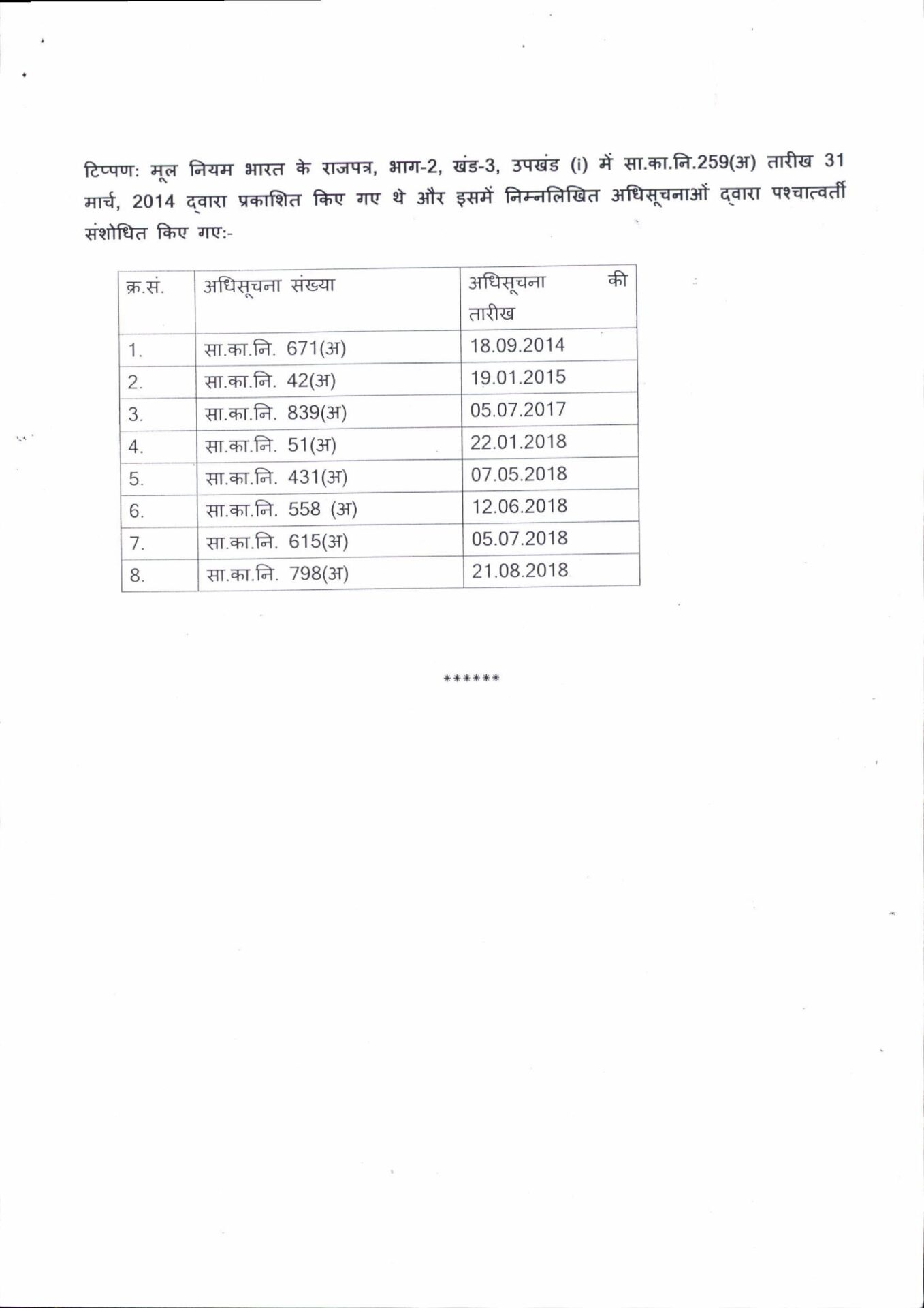

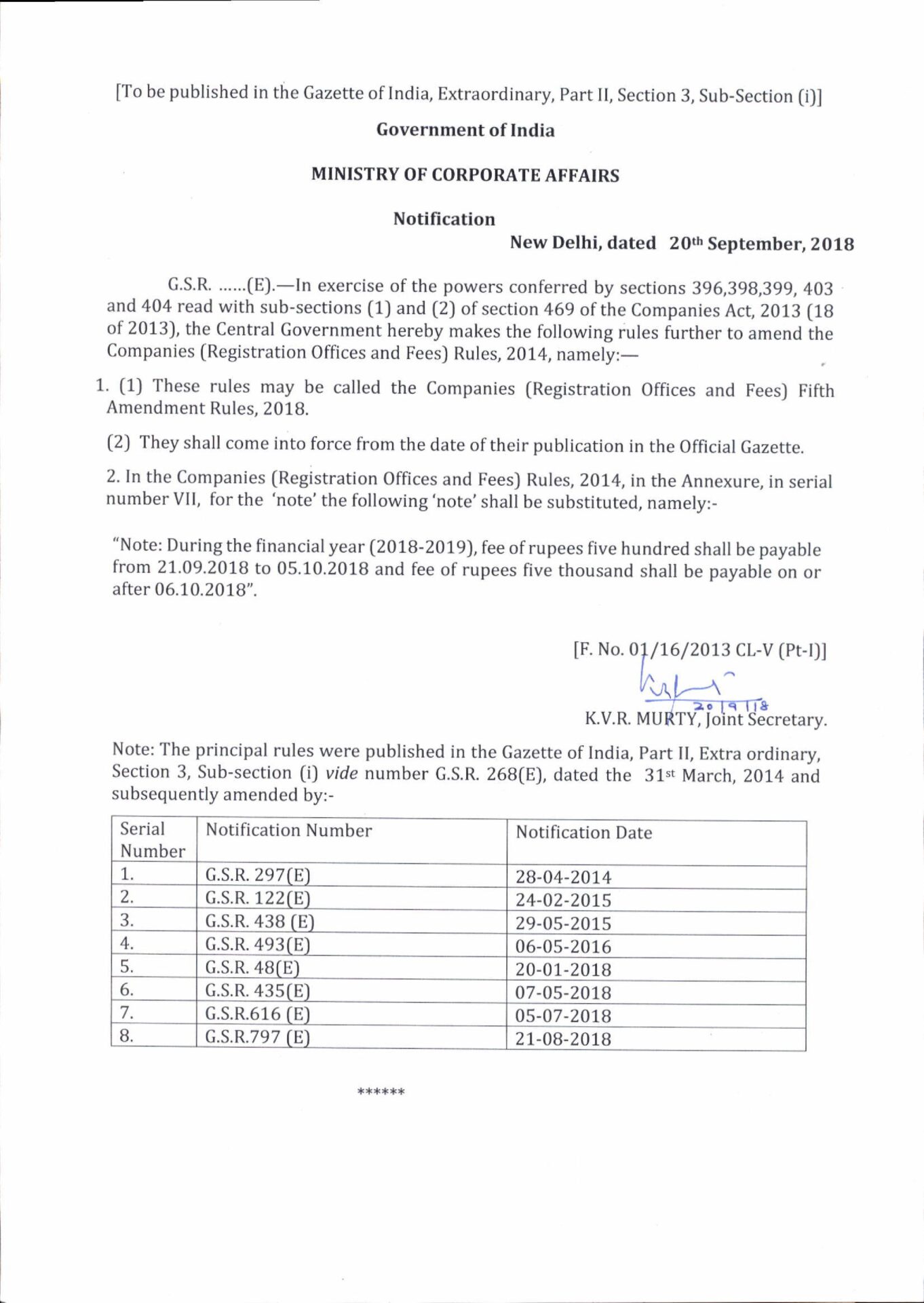

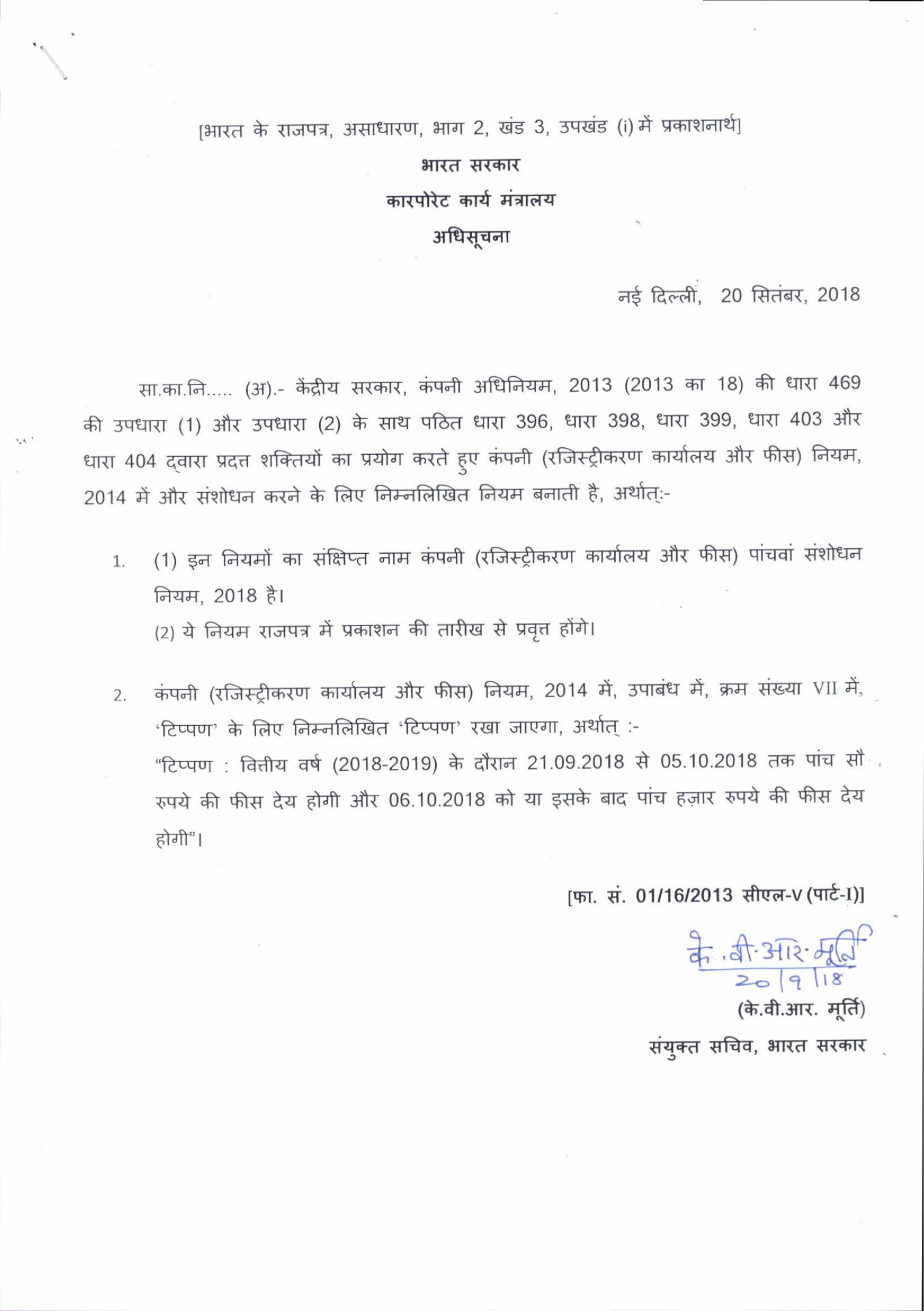

The Ministry of Corporate Affairs have published the Companies (Appointment and Qualification of Directors) Sixth Amendment Rules, 2018 and Companies (Registration Offices and Fees) Fifth Amendment Rules, 2018 in which it is stated that the due date for Form DIR 3 shall be extended to 5th October 2018 along with payment of late fee of Rs. 500/-.

This means those who have not been able to file the Form DIR 3 E KYC till 15th September 2018 shall have another opportunity to file the same by 5th October 2018 with late fee of Rs. 500/-.