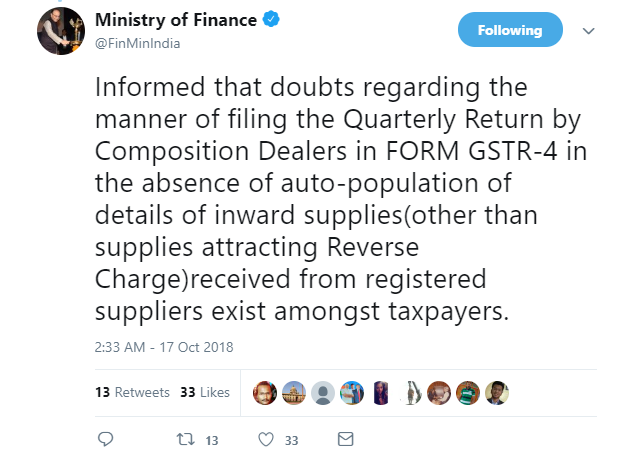

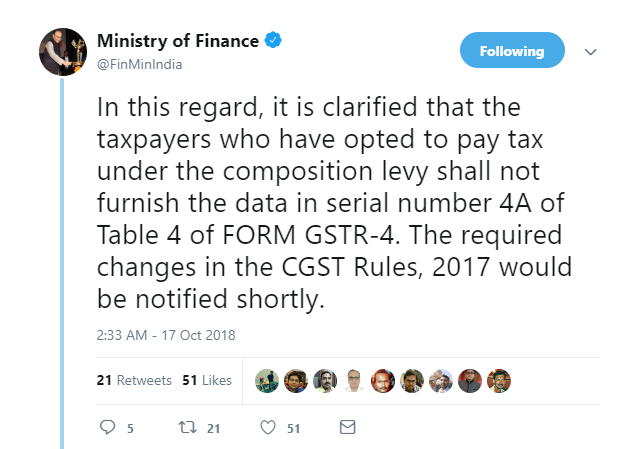

The Ministry of Finance in a recent tweet on its Twitter handle that amidst of the absence of auto populated information of inward supplies from registered suppliers (other than supplies received attracting reverse charge), the taxpayers who have opted to pay tax under the Composition levy shall not furnish the date in S.No. 4A of Table 4 of Form GSTR 4. The notification to effect such changes shall be notified shortly.