Failure to get the Accounts audited under section 63 of the Income Tax Act 2025

In the Finance Bill 2026, emphasis has been placed on converting penalties into graded fee....

Union Budget 2026

On 1st February 2026, the Union Finance Minister has presented the Finance Bill 2026 in...

Amendment in the Definition of Small Companies

On 1st December 2025, the Ministry of Corporate Affairs (MCA) has amended the definition of...

Insertion of Rule 3C and Rule 3D in the Income tax rules 1962

On 18th August 2025, the CBDT has released the Notification No. 133/2025 in which there...

Government of India notifies Income Tax Act 2025

The Income Tax Act 2025 has received the President’s assent on 21st August 2025. The...

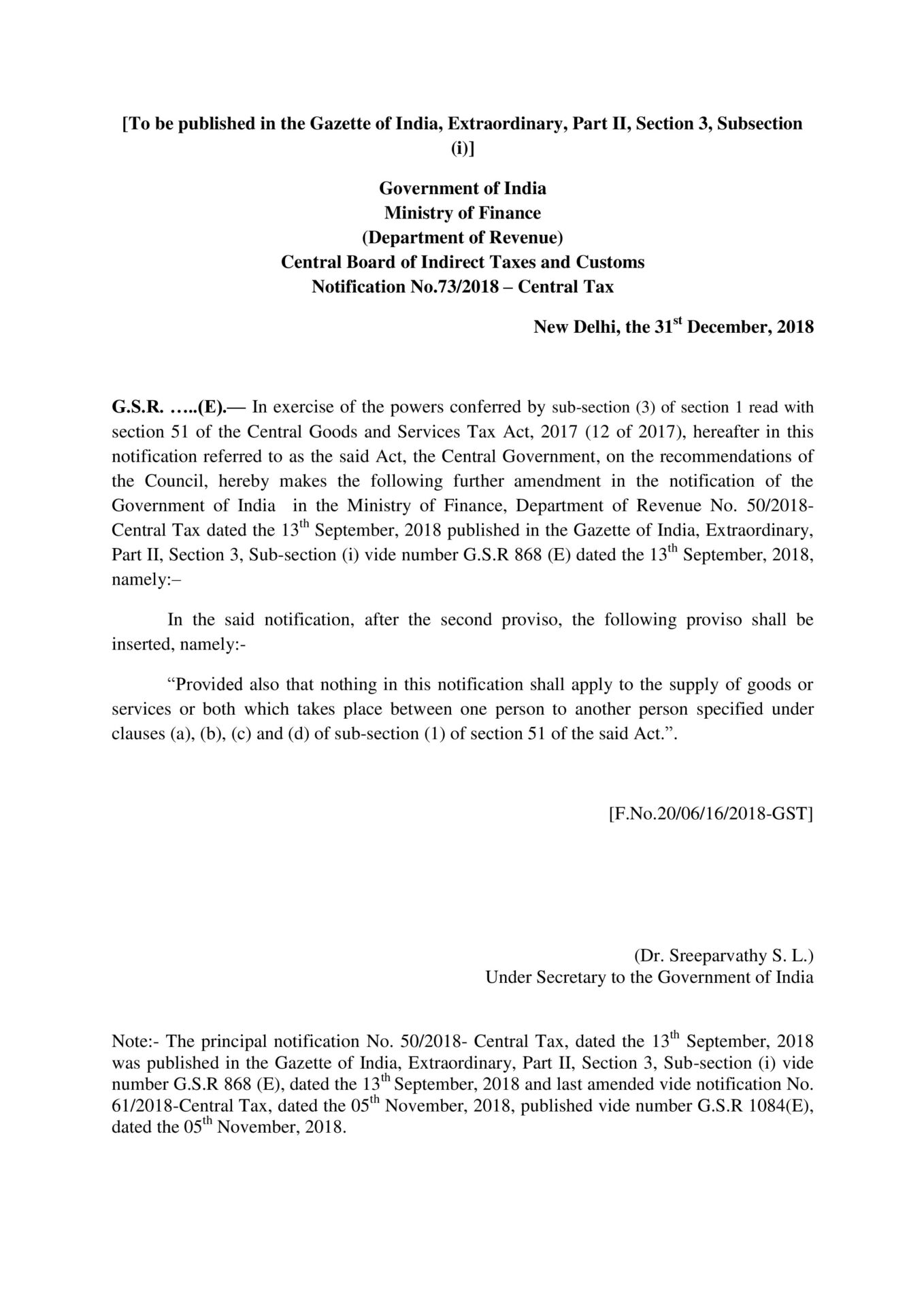

Extension of due date of filing of GSTR3B of July 2025 for selected regions of Maharashtra

Due to the heavy rains in the Maharashtra, the Central Board of Indirect Taxes &...