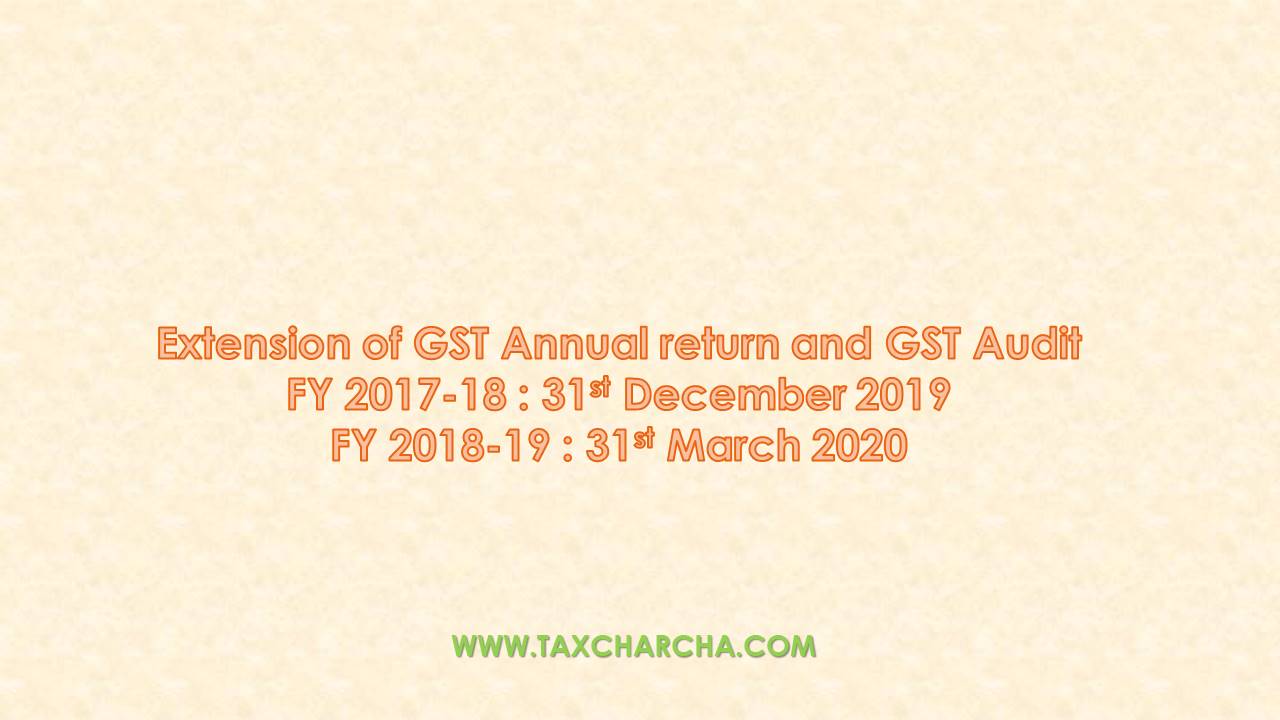

The Central Board of Indirect Taxes and Customs (CBIC) has extended the due date of GST Annual Returns (GSTR 9) and GST Audit (GSTR 9C). The due date for FY 2017-18 has been extended to 31st December 2019 and for FY 2018-19, it has been extended to 31st March 2020 respectively. The Government has also decided to simplify the forms by making certain fields optional such as bifurcation of input tax credit availed on inputs, input services and capital goods and not to provide HSN level information of outputs or inputs, etc. for the FY 2017-18 and 2018-19 respectively.

To view and download the press release, click below

Extension of GSTR 9 and GSTR 9C