The gross GST revenue collected in the month of March 2022 is ₹ 1,42,095 crore of which CGST is ₹ 25,830 crore, SGST is ₹ 32,378 crore, IGST is ₹ 74,470 crore (including ₹ 39,131 crore collected on import of goods) and cess is ₹ 9,417 crore (including ₹ 981 crore collected on import of goods). The gross GST collection in March’2022 is all time high breaching earlier record of ₹ 1,40,986 crore collected in the Month of January 2022.

The government has settled ₹ 29,816 crore to CGST and ₹ 25,032 crore to SGST from IGST as regular settlement. In addition, Centre has also settled Rs. 20,000 crore of IGST on ad-hoc basis in the ratio of 50:50 between Centre and States/UTs in this month. The total revenue of Centre and the States in the month of March 2022 after regular and ad-hoc settlements is ₹ 65646 crore for CGST and ₹ 67410 crore for the SGST. Centre also released GST compensation of ₹ 18,252 crore to States/UTs during the month.

The revenues for the month of March 2022 are 15% higher than the GST revenues in the same month last year and 46% higher than the GST revenues in March 2020. During the month, revenues from import of goods was 25% higher and the revenues from domestic transaction (including import of services) are 11% higher than the revenues from these sources during the same month last year. Total number of e-way bills generated in the month of February 2022 is 6.91 crore as compared to e-way bills generated in the month of January 2022 (6.88 crore) despite being a shorter month, which indicates recovery of business activity at faster pace.

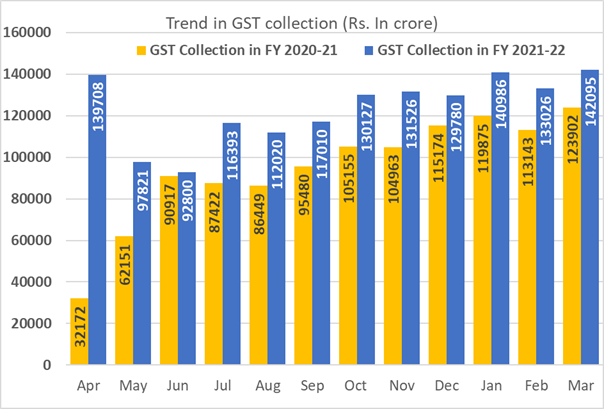

The average monthly gross GST collection for the last quarter of the FY 2021-22 has been ₹ 1.38 lakh crore against the average monthly collection of ₹ 1.10 lakh crore, ₹ 1.15 lakh crore and 1.30 lakh crore in the first, second and third quarters respectively. Coupled with economic recovery, anti-evasion activities, especially action against fake billers have been contributing to the enhanced GST. The improvement in revenue has also been due to various rate rationalization measures undertaken by the Council to correct inverted duty structure.

The chart below shows trends in monthly gross GST revenues during the current year. The table shows the state-wise figures of GST collected in each State during the month of March 2022 as compared to March 2021.

State-wise growth of GST Revenues during March 2022[1]

| State | Mar-21 | Mar-22 | Growth | |

| 1 | Jammu and Kashmir | 352 | 368 | 5% |

| 2 | Himachal Pradesh | 687 | 684 | 0% |

| 3 | Punjab | 1,362 | 1,572 | 15% |

| 4 | Chandigarh | 165 | 184 | 11% |

| 5 | Uttarakhand | 1,304 | 1,255 | -4% |

| 6 | Haryana | 5,710 | 6,654 | 17% |

| 7 | Delhi | 3,926 | 4,112 | 5% |

| 8 | Rajasthan | 3,352 | 3,587 | 7% |

| 9 | Uttar Pradesh | 6,265 | 6,620 | 6% |

| 10 | Bihar | 1,196 | 1,348 | 13% |

| 11 | Sikkim | 214 | 230 | 8% |

| 12 | Arunachal Pradesh | 92 | 105 | 14% |

| 13 | Nagaland | 45 | 43 | -6% |

| 14 | Manipur | 50 | 60 | 18% |

| 15 | Mizoram | 35 | 37 | 5% |

| 16 | Tripura | 88 | 82 | -7% |

| 17 | Meghalaya | 152 | 181 | 19% |

| 18 | Assam | 1,005 | 1,115 | 11% |

| 19 | West Bengal | 4,387 | 4,472 | 2% |

| 20 | Jharkhand | 2,416 | 2,550 | 6% |

| 21 | Odisha | 3,285 | 4,125 | 26% |

| 22 | Chhattisgarh | 2,544 | 2,720 | 7% |

| 23 | Madhya Pradesh | 2,728 | 2,935 | 8% |

| 24 | Gujarat | 8,197 | 9,158 | 12% |

| 25 | Daman and Diu | 3 | 0 | -92% |

| 26 | Dadra and Nagar Haveli | 288 | 284 | -2% |

| 27 | Maharashtra | 17,038 | 20,305 | 19% |

| 29 | Karnataka | 7,915 | 8,750 | 11% |

| 30 | Goa | 344 | 386 | 12% |

| 31 | Lakshadweep | 2 | 2 | 36% |

| 32 | Kerala | 1,828 | 2,089 | 14% |

| 33 | Tamil Nadu | 7,579 | 8,023 | 6% |

| 34 | Puducherry | 161 | 163 | 1% |

| 35 | Andaman and Nicobar Islands | 26 | 27 | 5% |

| 36 | Telangana | 4,166 | 4,242 | 2% |

| 37 | Andhra Pradesh | 2,685 | 3,174 | 18% |

| 38 | Ladakh | 14 | 23 | 72% |

| 97 | Other Territory | 122 | 149 | 22% |

| 99 | Centre Jurisdiction | 141 | 170 | 20% |

| Total | 91,870 | 1,01,983 | 11% |

[1] Does not include GST on import of goods