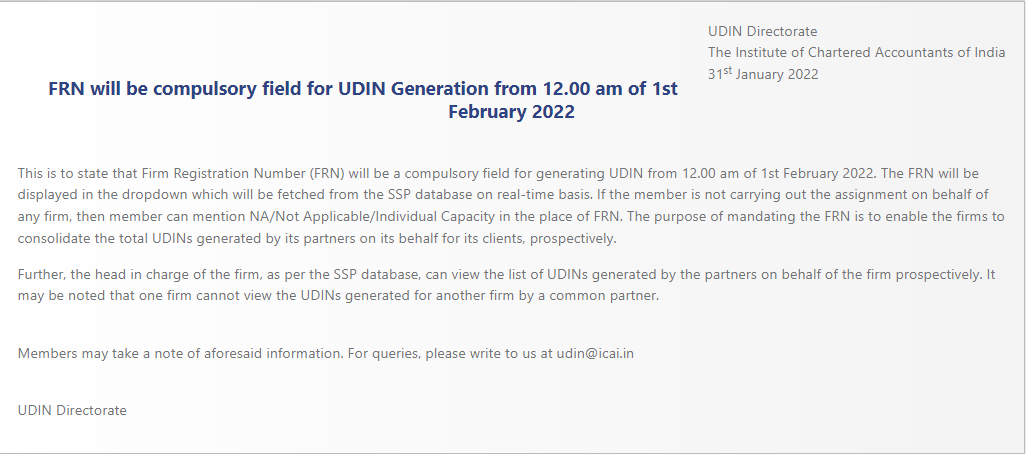

With effect from 1st February 2022, the ICAI has made it mandatory for the Members to enter FRN while generating the UDIN. In case the Member is carrying on the assignment and do not want the FRN to be entered, then N/A can be entered in the FRN field.

Also the Head of the Firm can view the list of UDINs generated on behalf of the Firm.