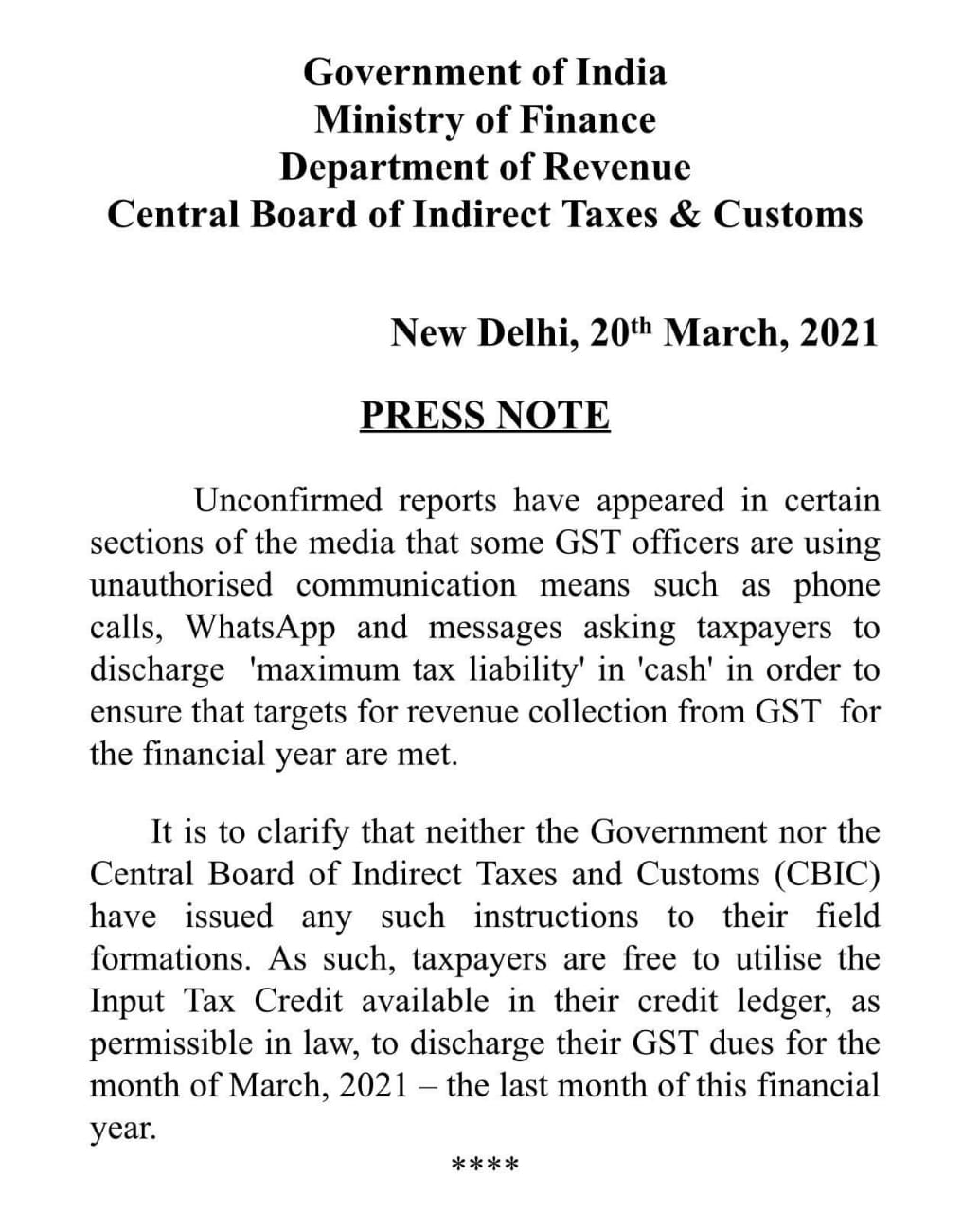

In a recent press release by the Central Board of Indirect Taxes and Customs (CBIC), it has been said that the CBIC is in the receipt of unconfirmed news that some GST officers are using unauthorised communication means such as phone calls, whatsapp and messages asking taxpayers to discharge ‘maximum tax liability’ in cash in order to ensure that targets for revenue collection from GST for the FY are met.

The CBIC has clarified that neither the Government nor the CBIC have issued any instructions to their field formations and the taxpayers are free to utilise the ITC available in their respective ledgers, as permissible in law, to discharge their GST dues for the month of March 2021.