ORDER :

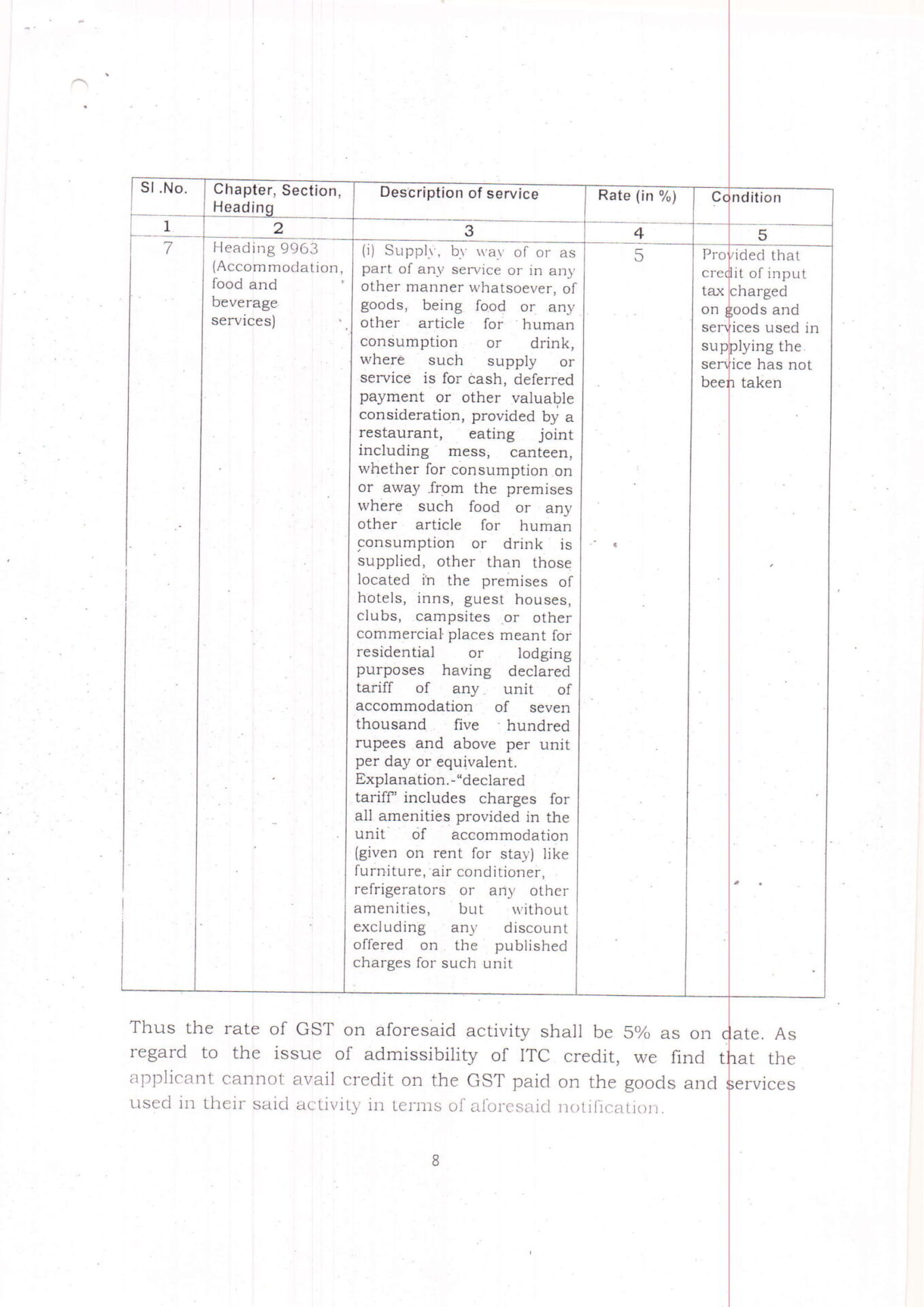

- The Supply of pure food items in the restaurant shall be treated as supply of service and sweet shop shall be treated as extension of restaurant.

- The rate of GST on aforesaid activity will be 5% as on date, on the condition that credit of input tax charged on goods and services used in supplying the said service has not been taken;

- All the items including takeaway items from the said premises shall attract GST of 5% as on the date subject to the condition of credit of input tax charged on goods and services used in supplying the said service.

To download the complete ruling, Click here