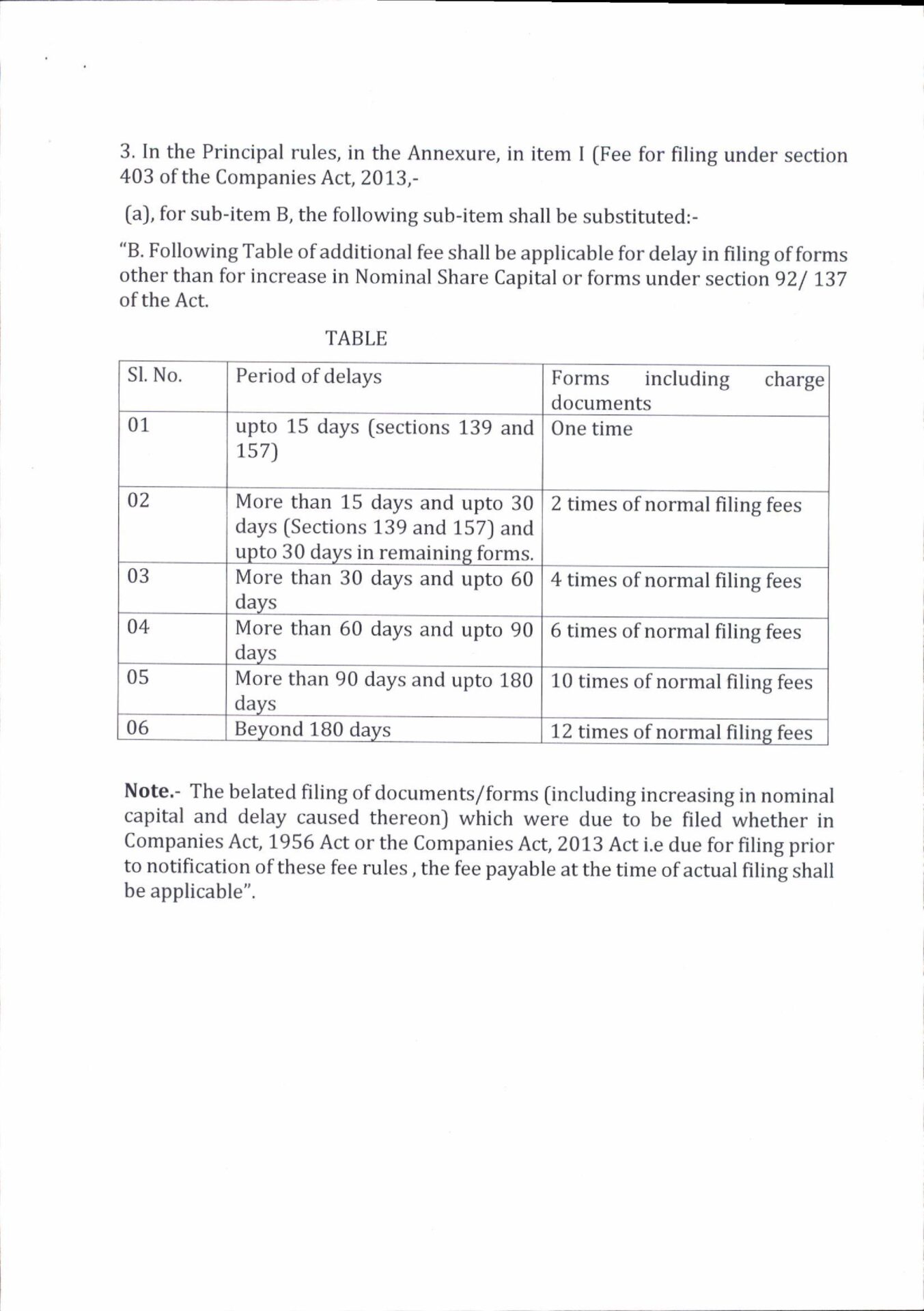

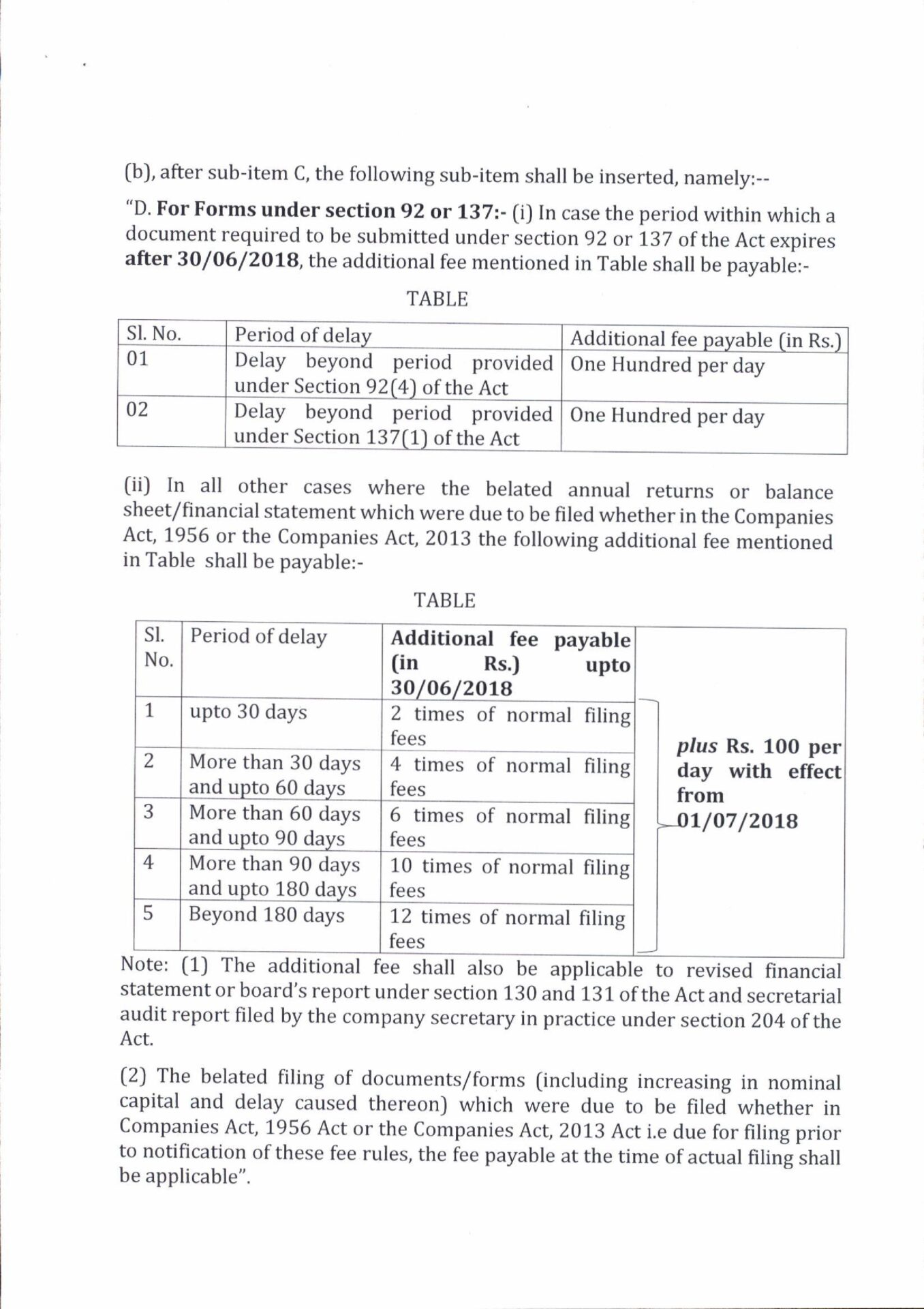

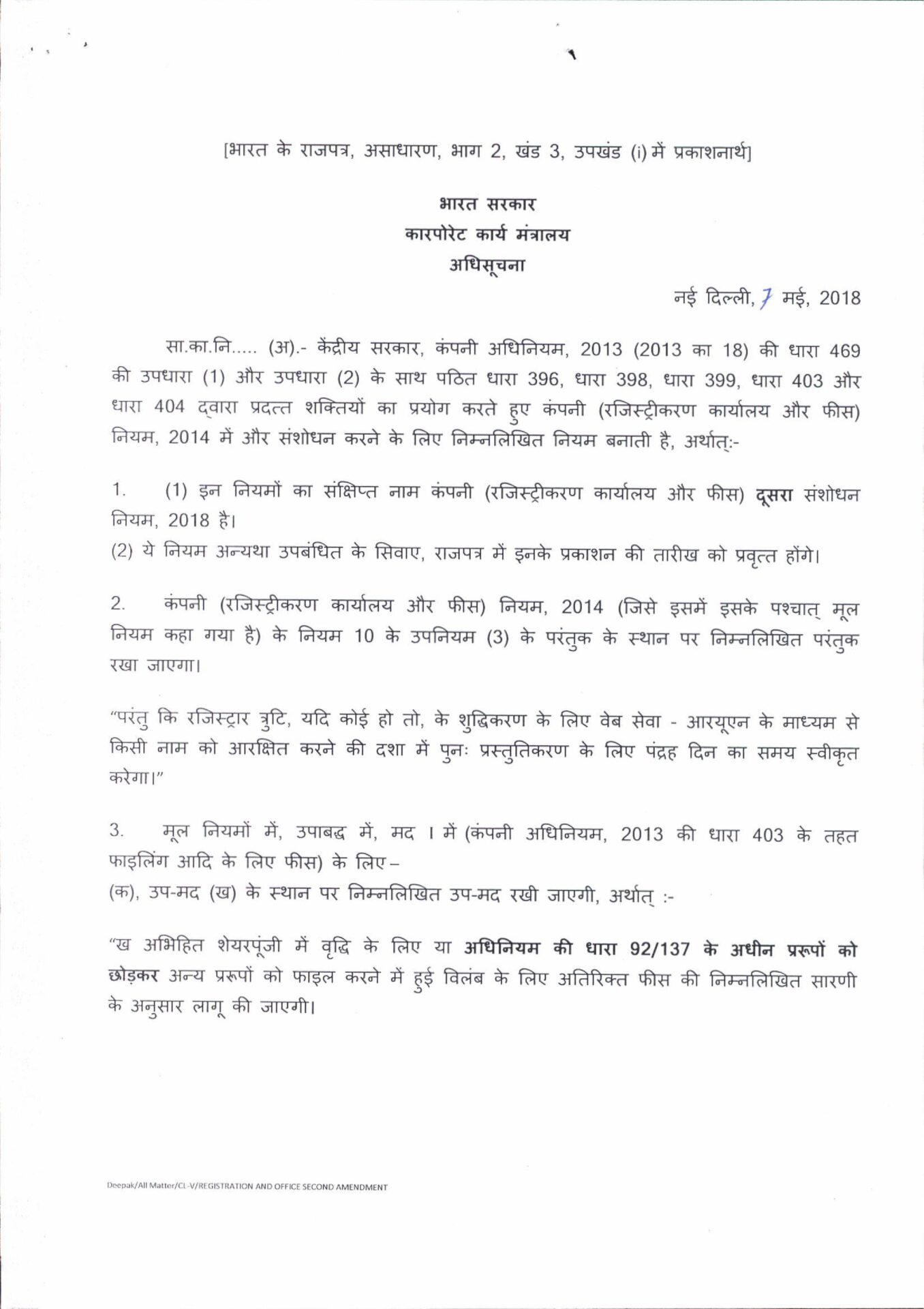

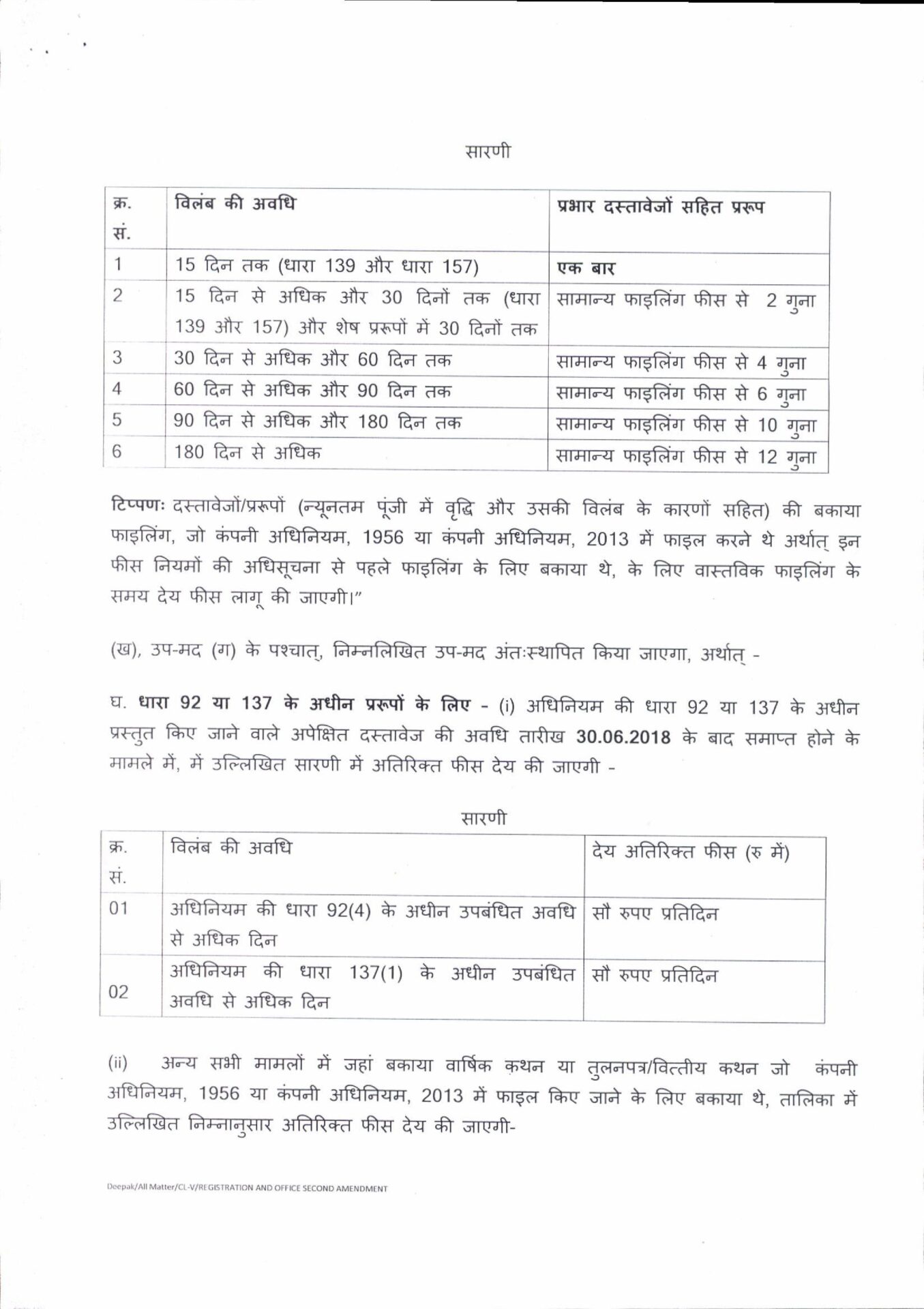

The Companies (Registration Offices and Fees) Second Amendment Rules 2018 has been notified on 7th May 2018. Accordingly, in case the due

date of filings under Section 92 (Annual Return) or 137 (Annual Financial Statement) of the Companies Act, 2013 expires after 30/06/2018, the additional fee @Rs.100 per day shall become payable in respect of

MGT-7, AoC-4, AoC-4 XBRL and AoC-4 CFS.

In all other cases where the belated annual returns or balance sheet/financial statement which were due to be filed whether under the Companies Act,1956 (23AC,23ACA,23AC XBRL,23ACA XBRL,20B,21A) or the Companies Act, 2013 (MGT-7, AoC-4, AoC-4 XBRL and AoC-4 CFS)additional fee as per the applicable slab for the period of delay up to 30th June 2018 plus @Rs.100 per day w.e.f 1st July 2018 shall become payable. Stakeholders are advised to take note and plan accordingly.