- Home

- GST

- Tax Notifications

- CGST Rate Notification

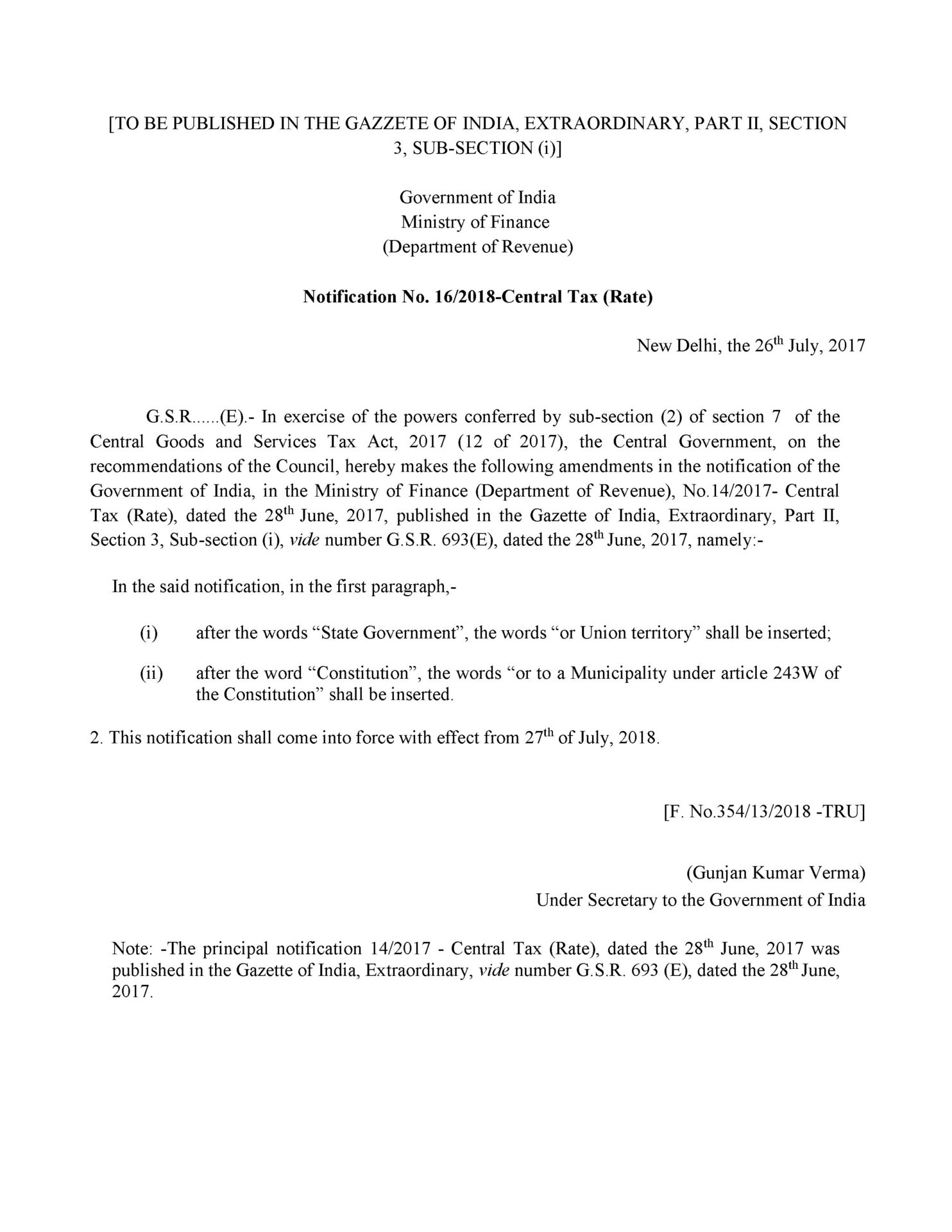

- Notification No. 16/2018-Central Tax (Rate) ,dt. 26-07-2018 – Seeks to amend notification No. 14/2017- Central Tax (Rate) to notify that services by way of any activity in relation to a function entrusted to a municipality under Article 243W shall be treated neither as a supply of good nor a service.