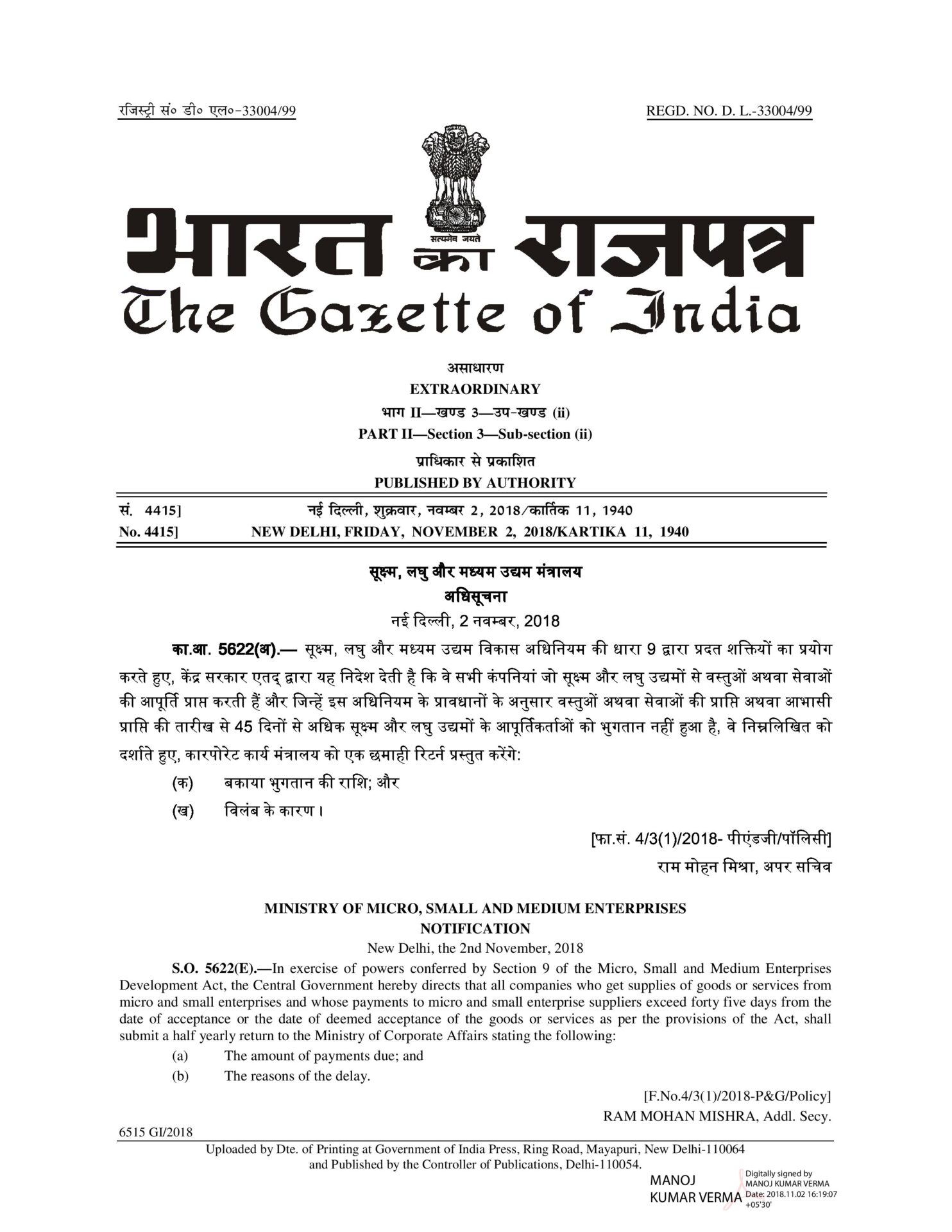

The Government of India, in its commitment towards the strengthening of the MSME sector, has published the Notification on 2nd November 2018 in which it has been stated that any Company which gets supplies from Micro and Small enterprises and whose payments to Micro and Small Enterprises exceed 45 days from the date of acceptance or date of the deemed acceptance of the goods or services, shall submit a half yearly return to the Ministry of Corporate Affairs, stating the following:-

a. The amount of payments due, and

b. The reasons for the delay