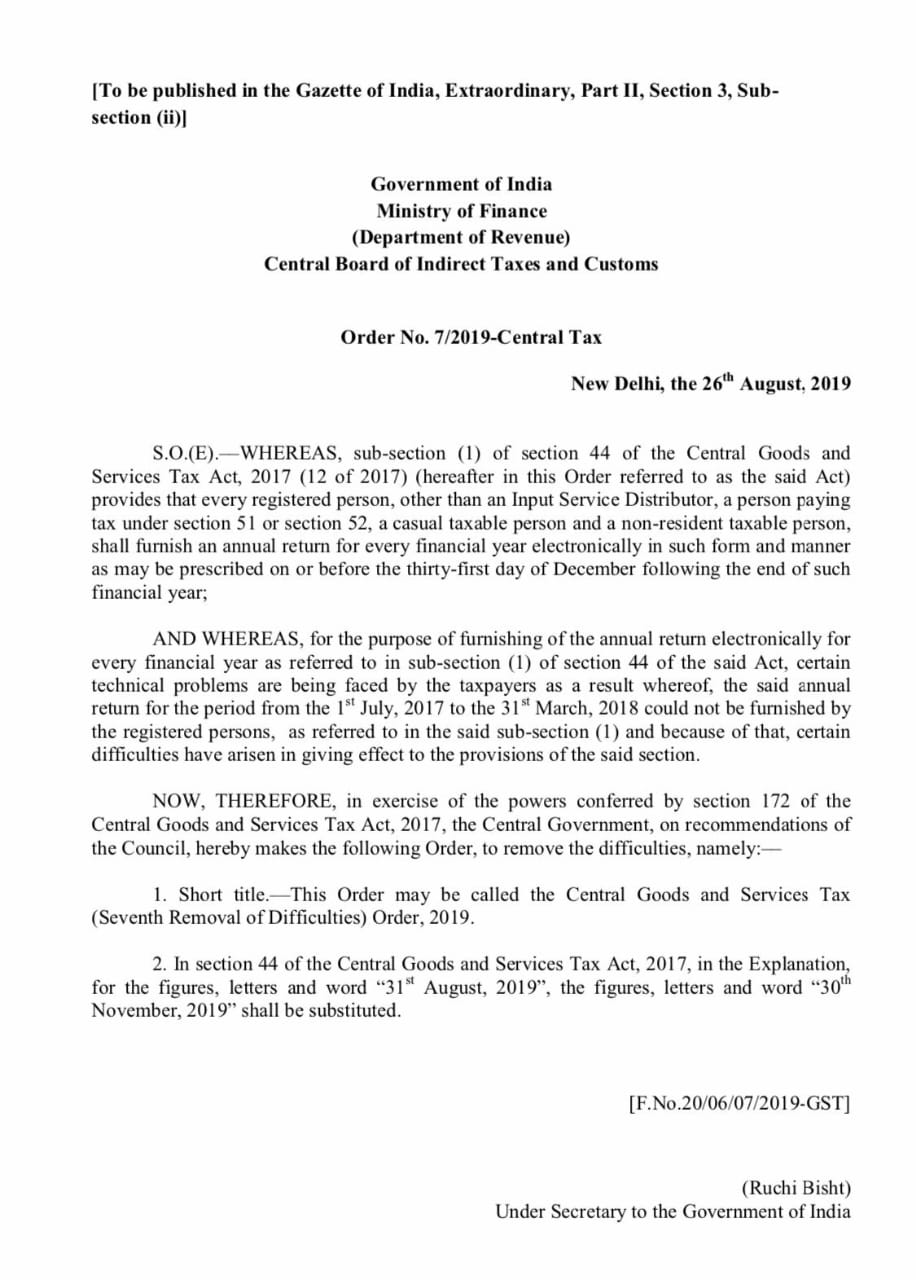

Central Board of Indirect Taxes and Customs has decided to extend the due date for the filing of GST Annual returns and GST Audit from 31st August to 30-11-2019. Various representations have been made by the Professional bodies regarding this and this has been seen as the need of the hour in view of the complexities of the Annual returns as well as the clashing with the due date of filing Income tax returns for the FY 2018-19.