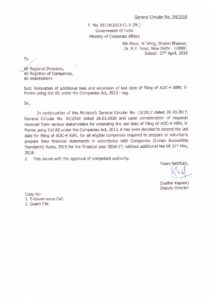

The Ministry of Corporate Affairs has extended the last date for filing of AOC-4 XBRL for all eligible companies required to prepare or voluntarily prepare their financial statements in accordance with Companies (Indian Accounting Standards) Rules, 2015 for the financial year 2016-17, without additional fee till 31st May 2018.

The Complete circular is attached herewith: