As we all know that the GST professionals have just concluded the mammoth task of finalising and filing the GST Annual returns and GST Audit for the FY 2017-18. Now for the FY 2018-19, the due date is 31-03-2020 by which the GST annual returns and GST audit for the Taxable persons whose aggregate turnover during the FY exceeds Rs. 2 Crores shall need to file the GSTR 9 and get the GST audit done by CA/CMA. For the FY 2018-19, the Department has not changed even a single line for the GSTR 9 as well as GSTR 9C which may leads to rounds of confusions and dilemmas in the minds of Professionals while finalising the Annual returns.

Now the following problem that arises at the time of finalising the GST annual returns are as follows:-

1.Reconciliation of Turnover for the FY 2018-19

In the tables 4, 5 and 6 of GSTR 9, the figures that have been auto populated belongs to the GSTR 1 filed during the period. Now, there can be cases where during the filing of GSTR 1, the turnover of FY 2017-18 might have been taken. So, in this case. there is no scope of subtracting that figure from the turnover of FY 2018-19 so that it can be reconciled with the books of accounts for the FY 2018-19. The Department should give a piece of thought

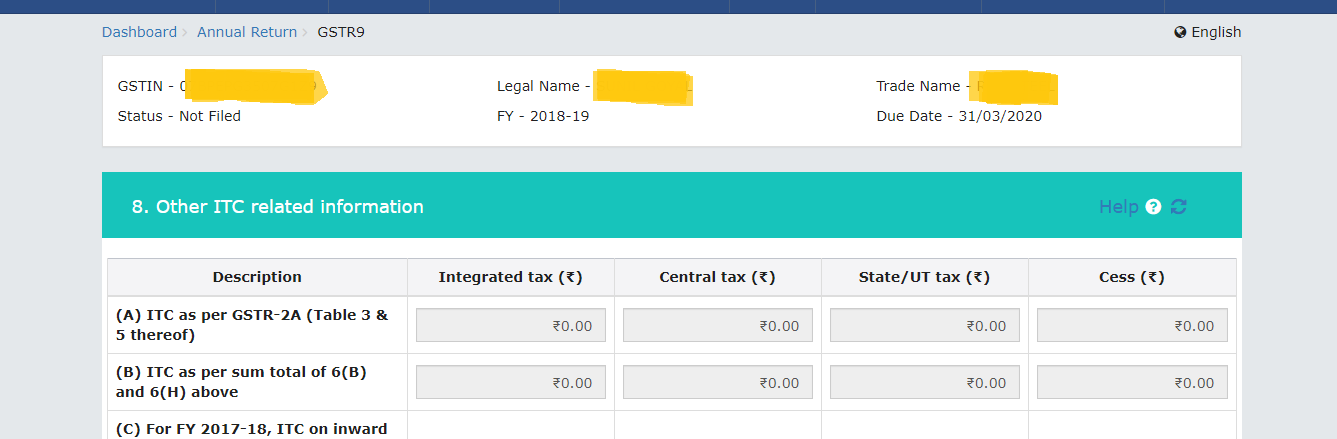

2. ITC as per GSTR 2A

Table 8 of the GSTR 9 have been taken as the benchmark for the reconciliation of the ITC between the GSTR 2A and the books of accounts during the filing of GST annual returns for the FY 2017-18. However, for the FY 2018-19, the figure has not been auto populated and it is still showing zero, thus leaving a question in the minds of the professionals, which figure to reconcile and with whom?

3.Reconciliation between ITC of FY 2018-19 and FY 2017-18

During the filing of GST returns, there might be cases that the taxable person would have taken the ITC for the FY 2017-18 in the FY 2018-19 or the supplier would have given the ITC credit for FY 2017-18 by amending their GSTR 1 in the FY 2018-19. So, in the present scenario, by looking at the nomenclature of the forms, it is almost impossible to bifurcate the ITC between the two financial years.

Thus, in the end, we would like to say that with the current unchanged forms, it would be very difficult to file the GSTR 9 for the FY 2018-19 and hence, almost impossible to file the GSTR 9C as we have to reconcile the figures of the books of accounts with the GSTR 9 figures and with the current forms, it would not be feasible to reach the correct figure in the GSTR 9. Hence, the Department should review the forms again and revise the particulars of the forms to enable the Tax Professionals to file the GST Annual returns in an accurate and meticulous manner.