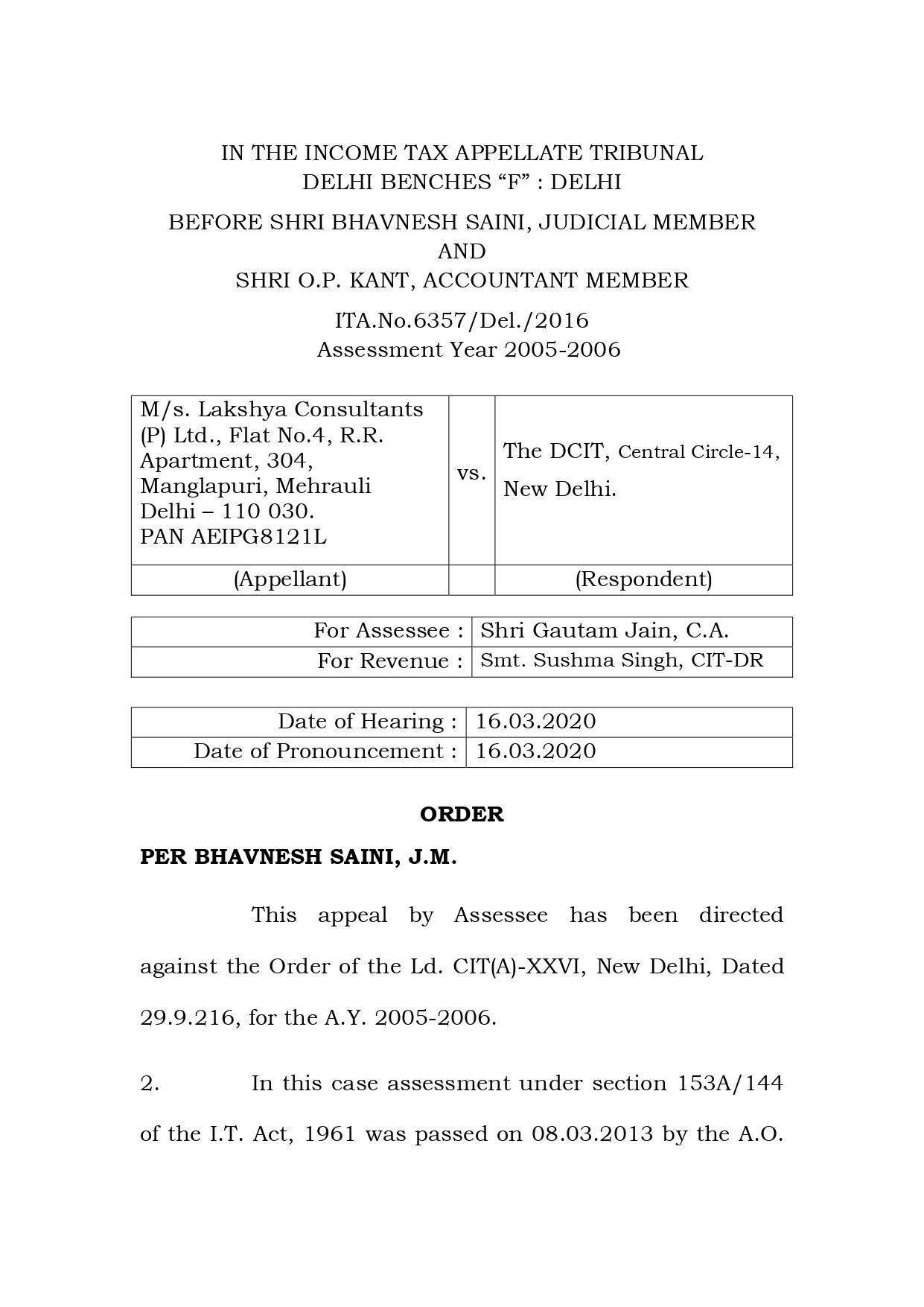

Where the CIT(A) decided the appeal that that no assessment could be framed under section 153A because no incriminating document was found during the course of search against the assessee and no appeal is filed by the Department against such order, therefore the appeal of assessee is academic in nature only. And appeal of assessee is dismissed as withdrawn.