The gross Good & Services Tax (GST) revenue collected in the month of May, 2023 is ₹1,57,090 crore of which CGST is ₹28,411 crore, SGST is ₹35,828 crore, IGST is ₹81,363 crore (including ₹41,772 crore collected on import of goods) and cess is ₹11,489 crore (including ₹1,057 crore collected on import of goods).

The government has settled ₹35,369 crore to CGST and ₹29,769 crore to SGST from IGST. The total revenue of Centre and the States in the month of May 2023 after regular settlement is ₹63,780 crore for CGST and ₹65,597 crore for the SGST.

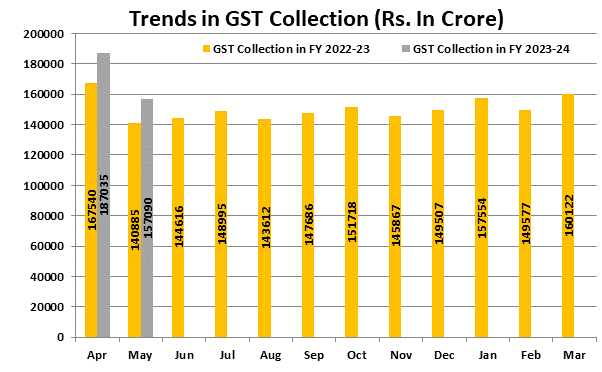

The revenues for the month of May 2023 are 12% higher than the GST revenues in the same month last year. During the month, revenue from import of goods was 12% higher and the revenues from domestic transactions (including import of services) are 11% higher than the revenues from these sources during the same month last year.

The chart below shows trends in monthly gross GST revenues during the current year. The table shows the state-wise figures of GST collected in each State during the month of May 2023 as compared to May 2022.

State-wise growth of GST Revenues during May 2023[1]

| State/UT | May-22 | May-23 | Growth(%) |

| Jammu and Kashmir | 372 | 422 | 14 |

| Himachal Pradesh | 741 | 828 | 12 |

| Punjab | 1833 | 1744 | -5 |

| Chandigarh | 167 | 259 | 55 |

| Uttarakhand | 1309 | 1431 | 9 |

| Haryana | 6663 | 7250 | 9 |

| Delhi | 4113 | 5147 | 25 |

| Rajasthan | 3789 | 3924 | 4 |

| Uttar Pradesh | 6670 | 7468 | 12 |

| Bihar | 1178 | 1366 | 16 |

| Sikkim | 279 | 334 | 20 |

| Arunachal Pradesh | 82 | 120 | 47 |

| Nagaland | 49 | 52 | 6 |

| Manipur | 47 | 39 | -17 |

| Mizoram | 25 | 38 | 52 |

| Tripura | 65 | 75 | 14 |

| Meghalaya | 174 | 214 | 23 |

| Assam | 1062 | 1217 | 15 |

| West Bengal | 4896 | 5162 | 5 |

| Jharkhand | 2468 | 2584 | 5 |

| Odisha | 3956 | 4398 | 11 |

| Chattisgarh | 2627 | 2525 | -4 |

| Madhya Pradesh | 2746 | 3381 | 23 |

| Gujarat | 9321 | 9800 | 5 |

| Dadra and Nagar Haveli and Daman and Diu | 300 | 324 | 8 |

| Maharashtra | 20313 | 23536 | 16 |

| Karnataka | 9232 | 10317 | 12 |

| Goa | 461 | 523 | 13 |

| Lakshadweep | 1 | 2 | 210 |

| Kerala | 2064 | 2297 | 11 |

| Tamil Nadu | 7910 | 8953 | 13 |

| Puducherry | 181 | 202 | 12 |

| Andaman and Nicobar Islands | 24 | 31 | 27 |

| Telangana | 3982 | 4507 | 13 |

| Andhra Pradesh | 3047 | 3373 | 11 |

| Ladakh | 12 | 26 | 113 |

| Other Territory | 185 | 201 | 9 |

| Center Jurisdiction | 140 | 187 | 34 |

| Grand Total | 102485 | 114261 | 11 |

To view and download the Press Release, click here