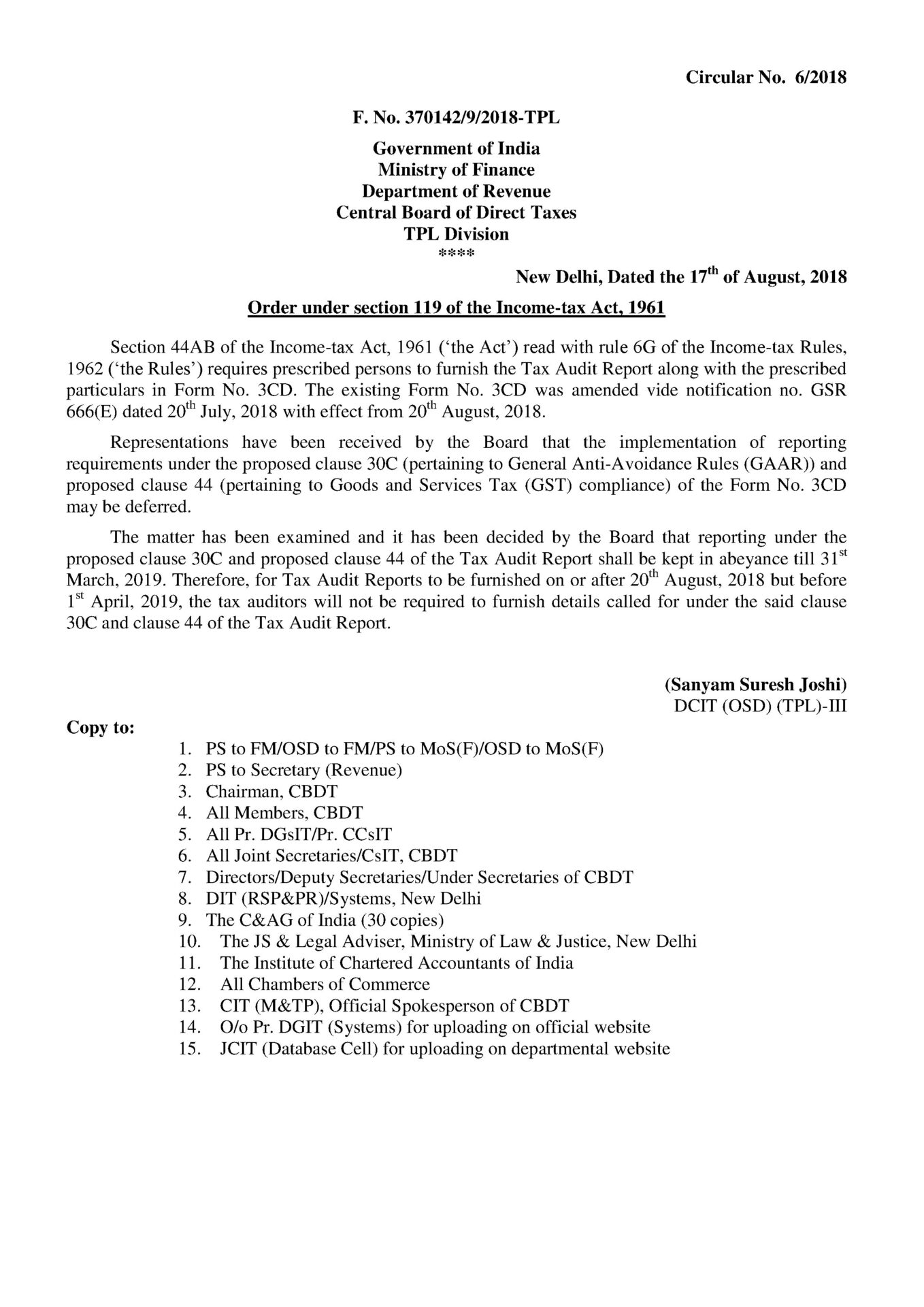

CBDT has deferred the implementation of reporting requirement under the proposed clause 30C(pertaining to General Anti-Avoidance Rules (GAAR)) and proposed clause 44 (pertaining to Goods and Services Tax (GST) compliance) of the Form 3CD till 31st March 2019.

To download the Circular, click here cbdt-circular-6-2018-dt-17-aug-2018-clause-30c-and-44-of-revised-form-3cd-deferred-upto-31-march-2019