The Ministry of Corporate Affairs has increased the fee of Form STK 2 from Rs. 5,000/- to Rs. 10,000/- with effect from 10-05-2019. It has been specifically mentioned in the Notification that if the Annual returns have not been filed by the Company during which the Company ceases to carry out its operations, then no Form STK 2 shall be filed by the Company. Also if a notice in Form STK 7 has been issued by the Registrar then the Company can not file the Form STK 2.

BELOW IS THE NOTIFICATION

MINISTRY OF CORPORATE AFFAIRS

NOTIFICATION

New Delhi, the 8th May, 2019

G.S.R. 350(E).—In exercise of the powers conferred by sub-sections (1), (2) and Sub-section (4) of section 248 read with section 469 of the Companies Act, 2013 (18 of 2013), the Central Government hereby makes the following rules further to amend the Companies (Removal of Names of Companies from the Register of Companies) Rules, 2016 , namely:-

(1) These rules may be called the Companies (Removal of Names of Companies from the Register of Companies) Amendment Rules, 2019.

(2) They shall come into force with effect from 10th May, 2019.

In the Companies (Removal of Names of Companies from the Register of Companies) Rules, 2016 (hereinafter referred to as the principal rules), in rule 4,

(a) in sub-rule (1), for the words “five thousand rupees”, the following shall be substituted, namely:- “ten thousand rupees:

Provided that no application in Form No. STK-2 shall be filed by a company unless it has filed overdue returns in Form No. AOC-4 (Financial Statement) or AOC-4 XBRL, as the case may be, and Form No. MGT-7 (Annual Return), up to the end of the financial year in which the company ceased to carry its business operations:

Provided further that in case a company intends to file Form No. STK-2 after the action under sub-section (1) of section 248 has been initiated by the Registrar, it shall file all pending overdue returns in Form No. AOC-4 (Financial Statement) or AOC-4 XBRL, as the case may be, and Form No. MGT-7 (Annual Return) before filing Form No. STK-2:

Provided also that once notice in Form No. STK-7 has been issued by the Registrar pursuant to the action initiated under sub-section (1) of section 248, a company shall not be allowed to file an application in Form No. STK-2.

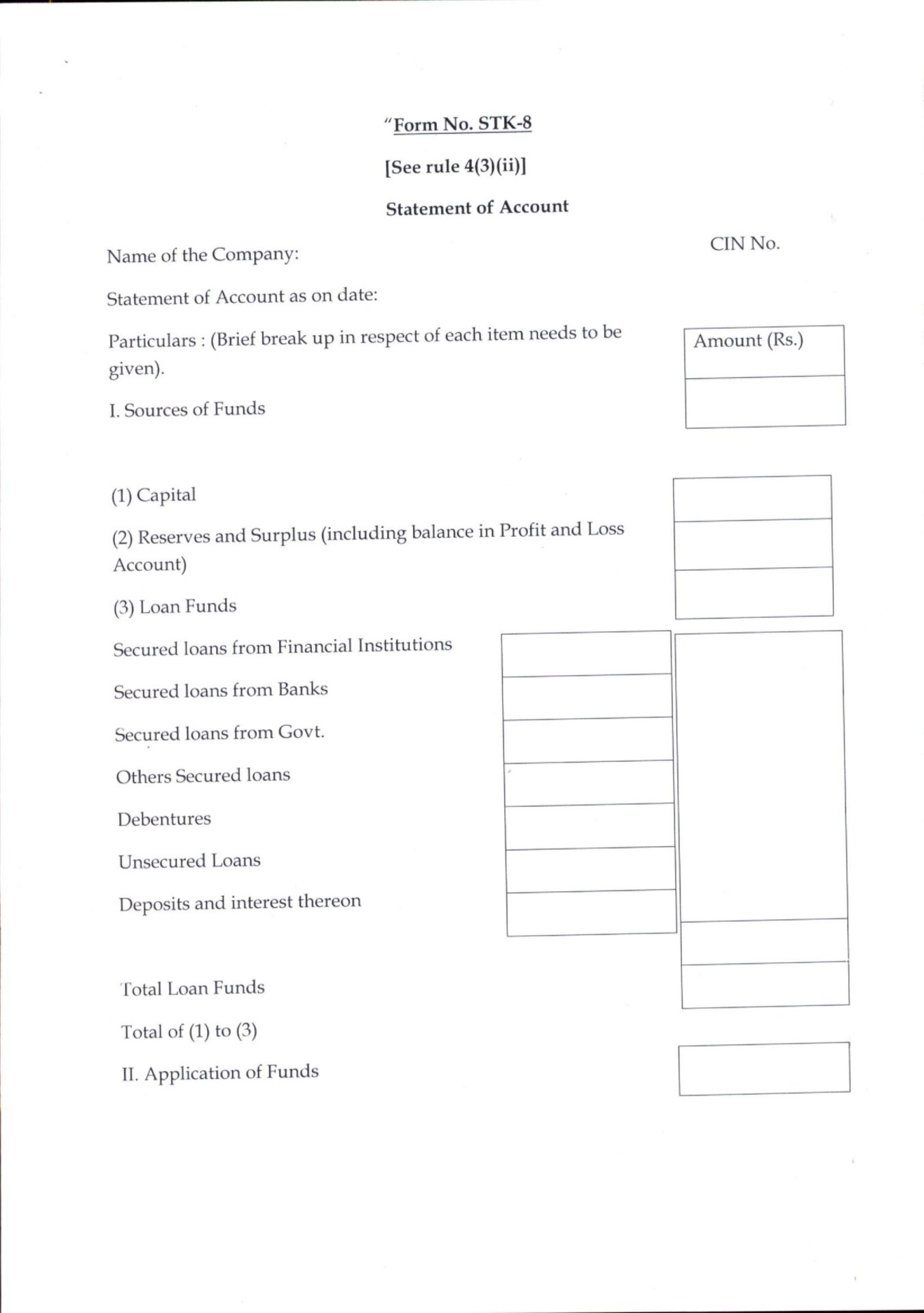

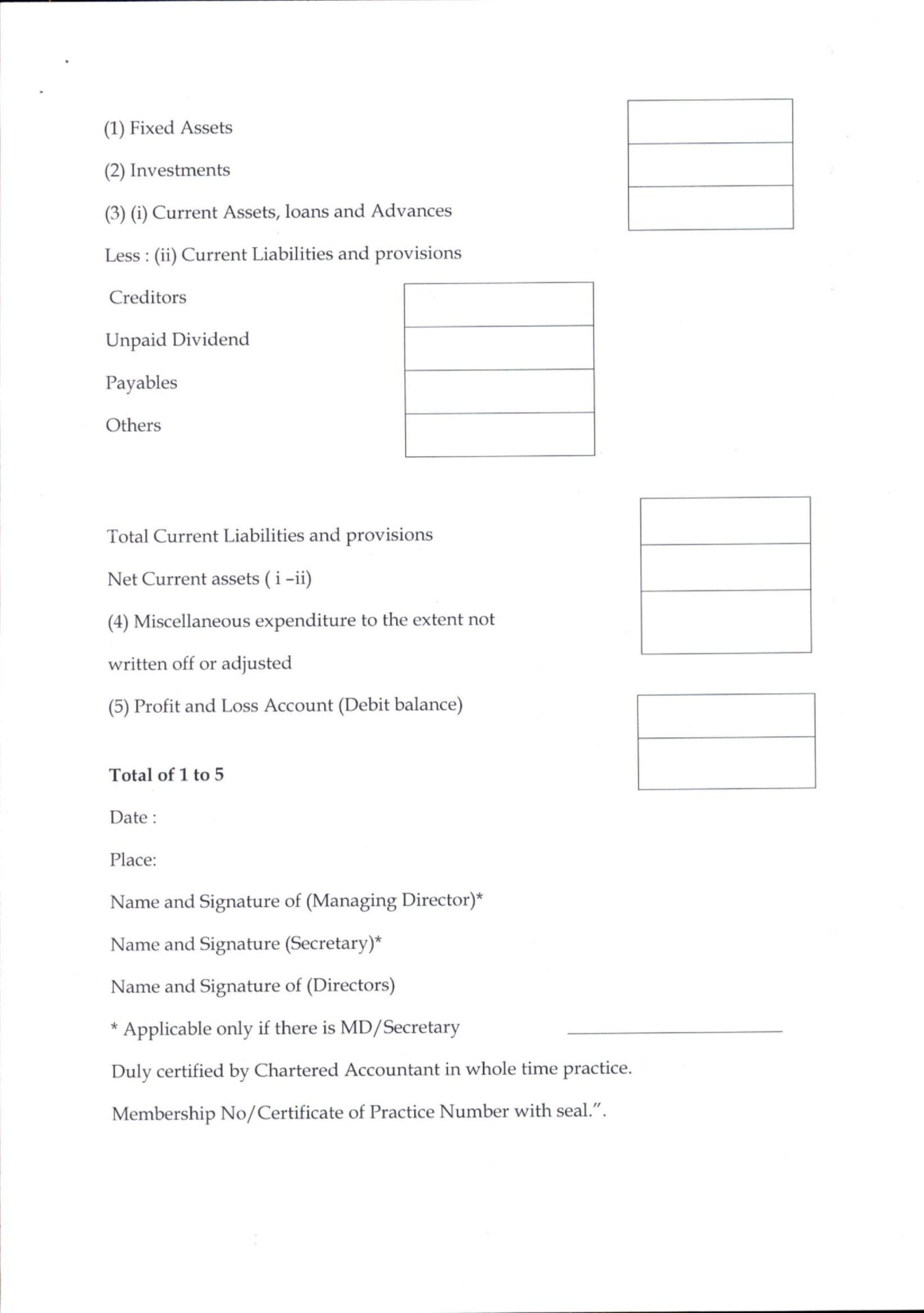

in sub-rule (3), in clause (ii), after the words, “statement of accounts”, the words, letters and figures “in Form No. STK-8” shall be inserted.

In the Annexure to the principal rules,

in Form No. STK-4, in Serial Number 2, after item (vii), the following item shall be inserted, namely:-

“(viii) The company has fulfilled all pending compliances, if any [Applicable in case an application under sub-section

(2) of section 248 has been filed after the initiation of action under sub-section (1) of section 248].

after Form No. STK -7, the following Form shall be inserted, namely:-

Source – Ministry of Corporate Affairs

http://www.mca.gov.in/Ministry/pdf/AmendmentRules_08052019.pdf