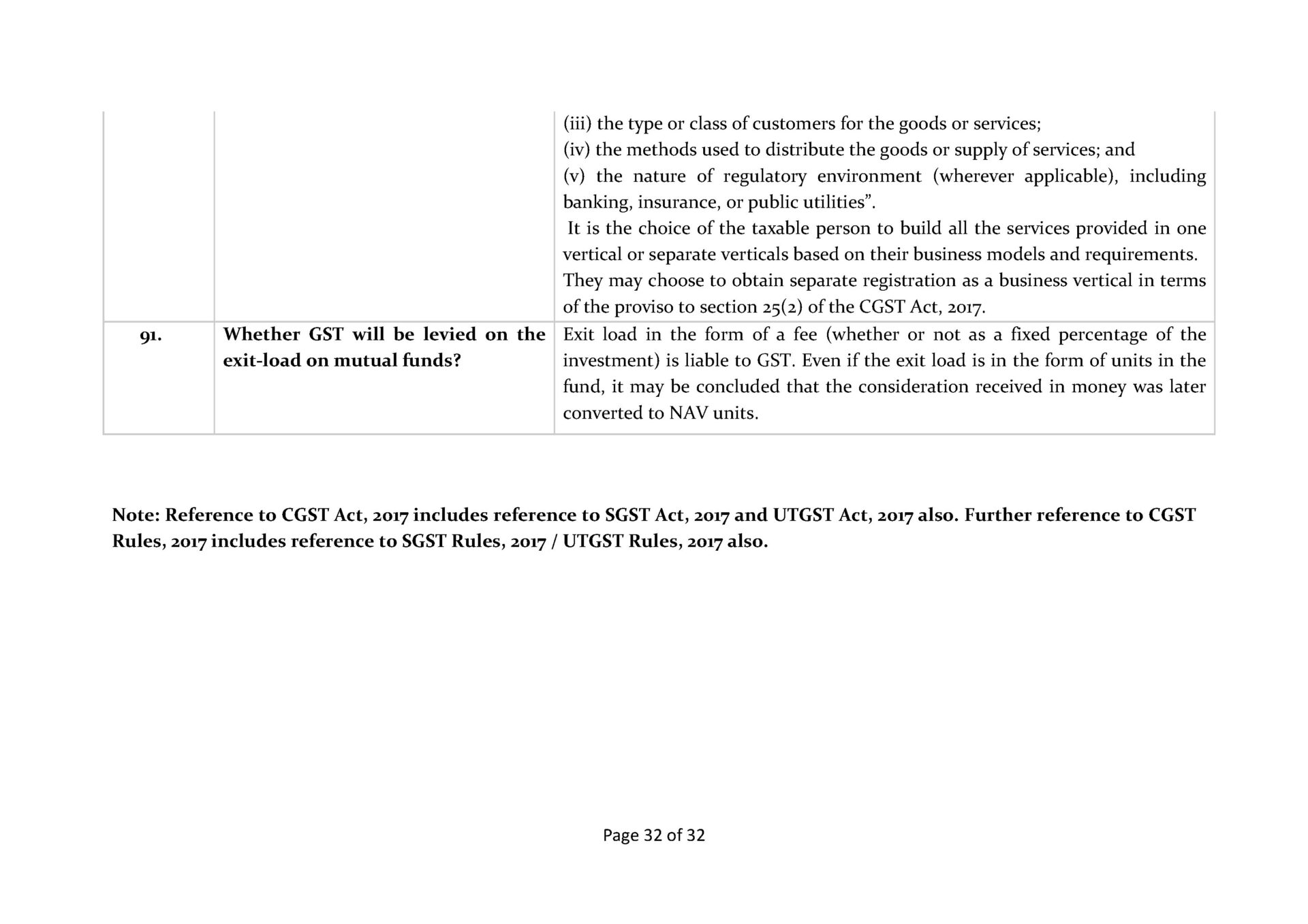

A big relief comes to the Banking customers as the Government on sunday clarified that the services such as withdrawals from ATMs, issuance of chequebooks to the customers will not the taxable under the GST regime. However, the interest charged on outstanding credit card dues, finance lease and exit fees paid by the investors of mutual funds will be taxable under GST regime. The interest levied on the loans are not taxed, so in the same lines, additional interest for delayed payment has also been kept out of GST.

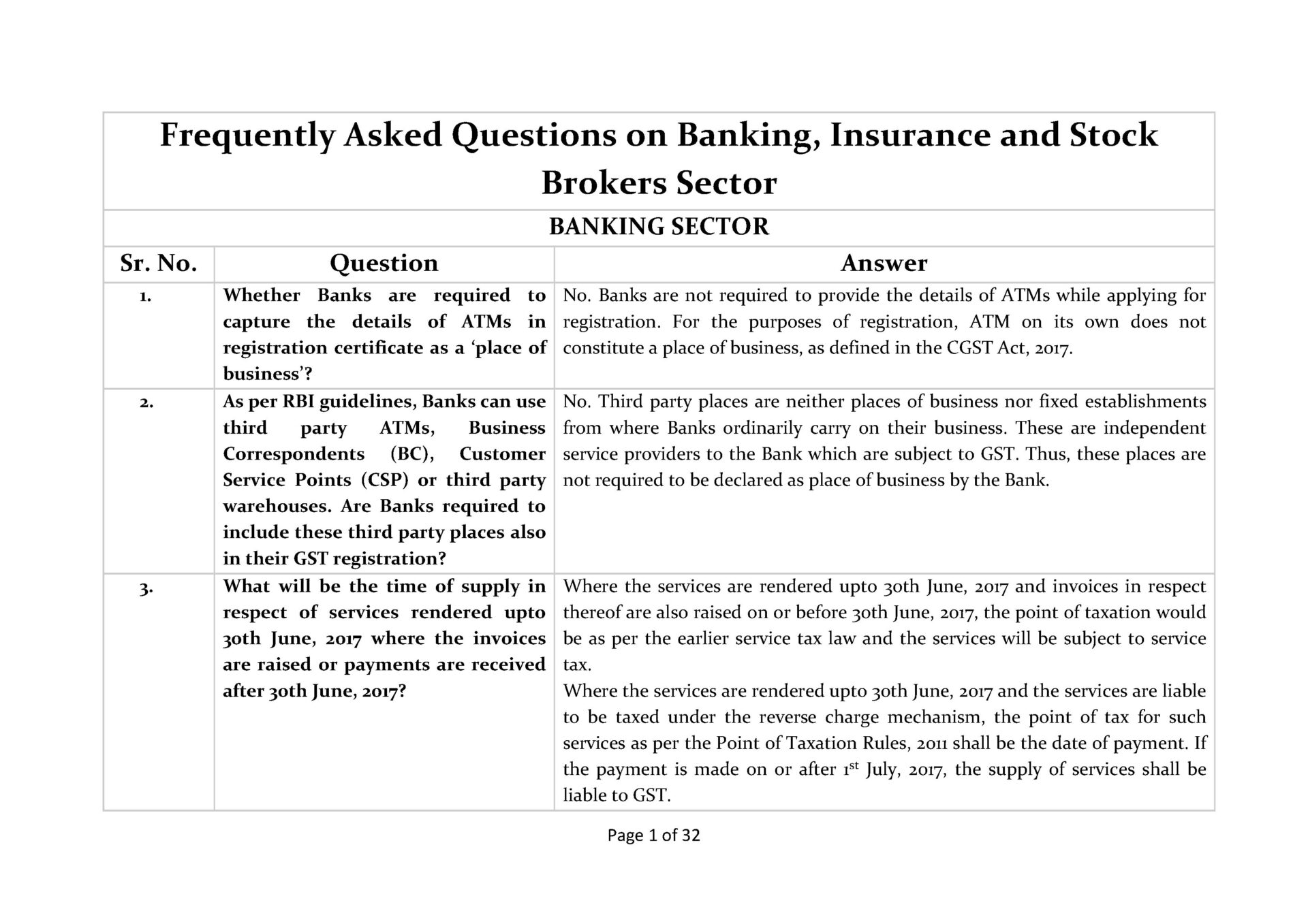

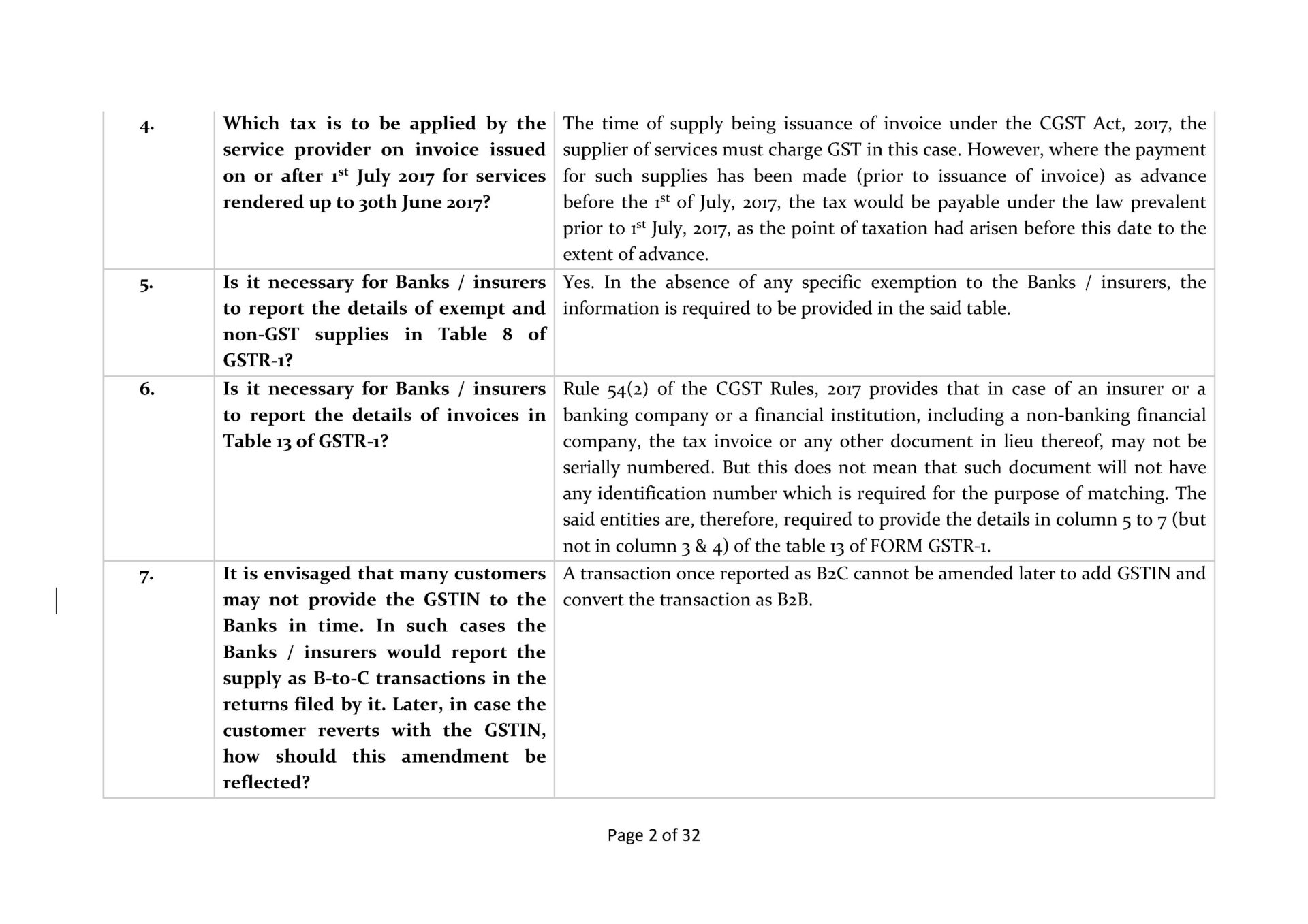

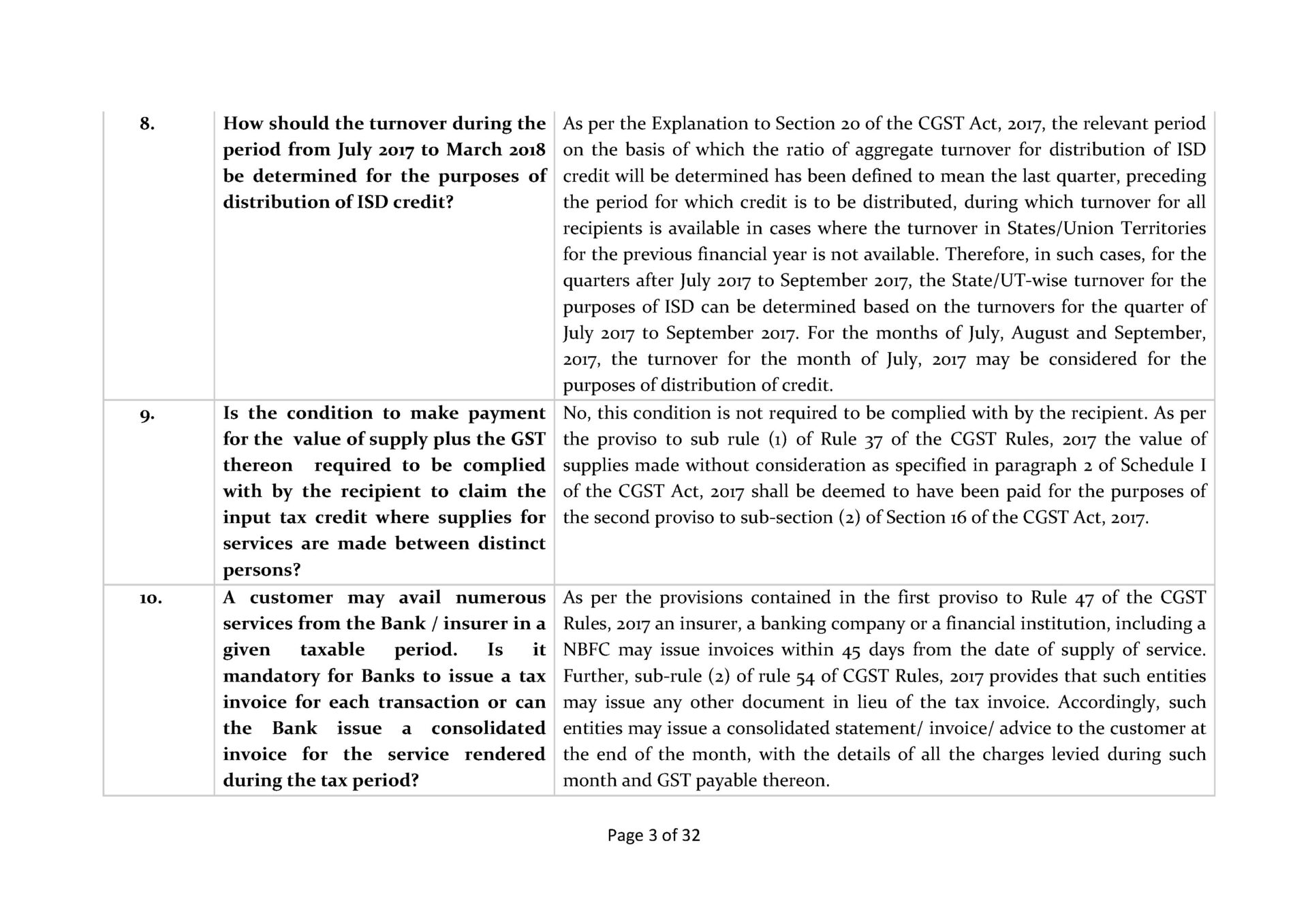

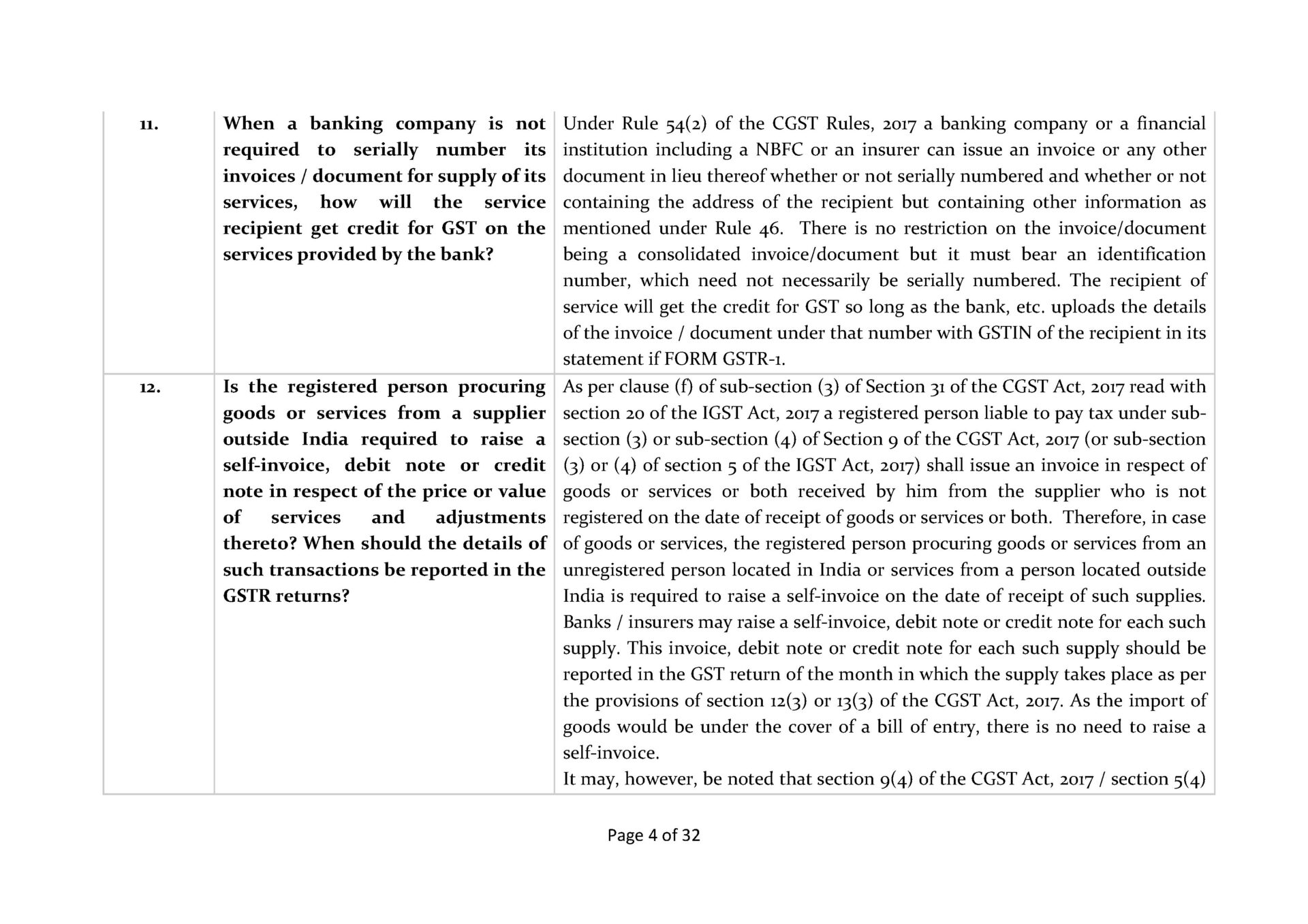

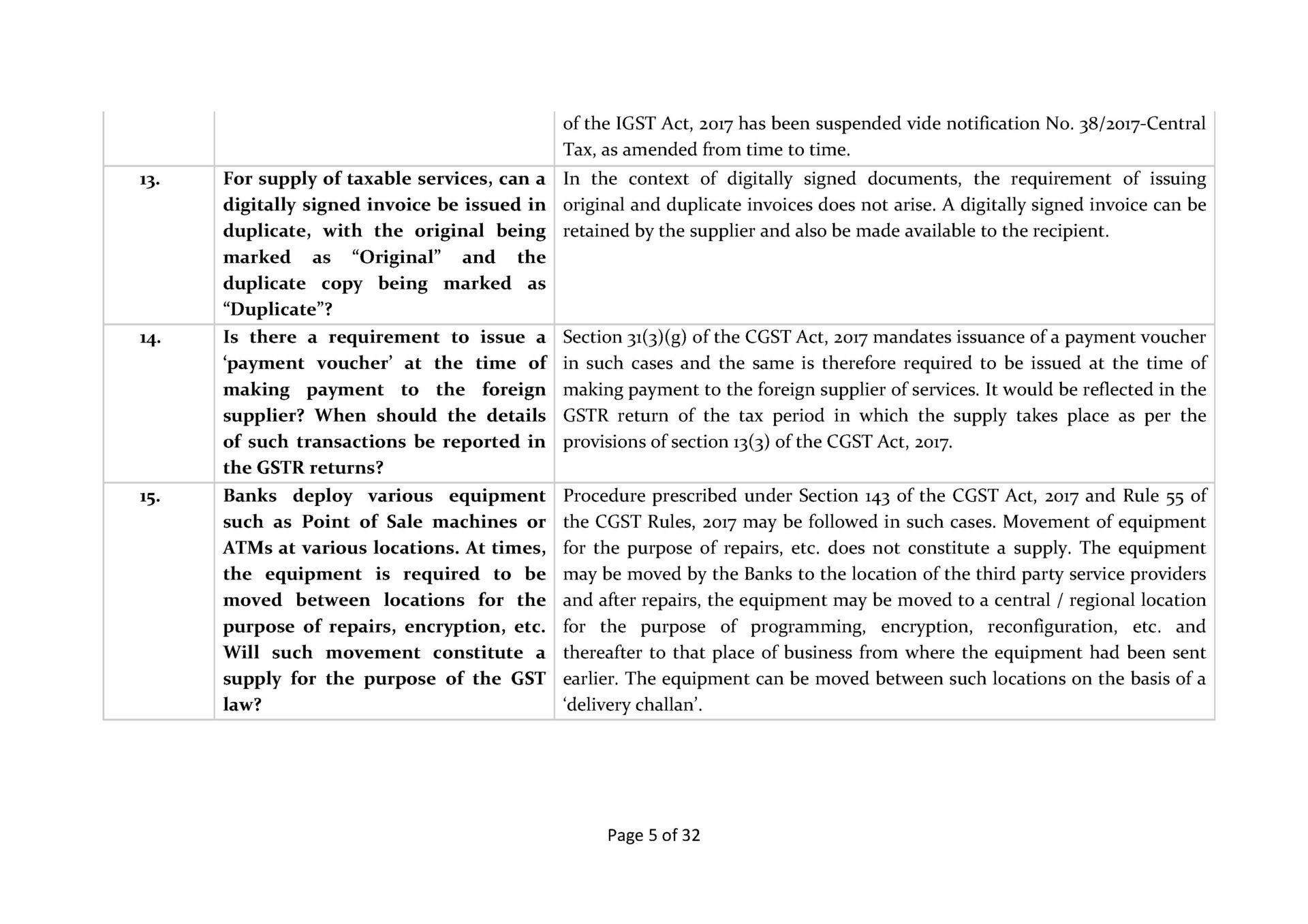

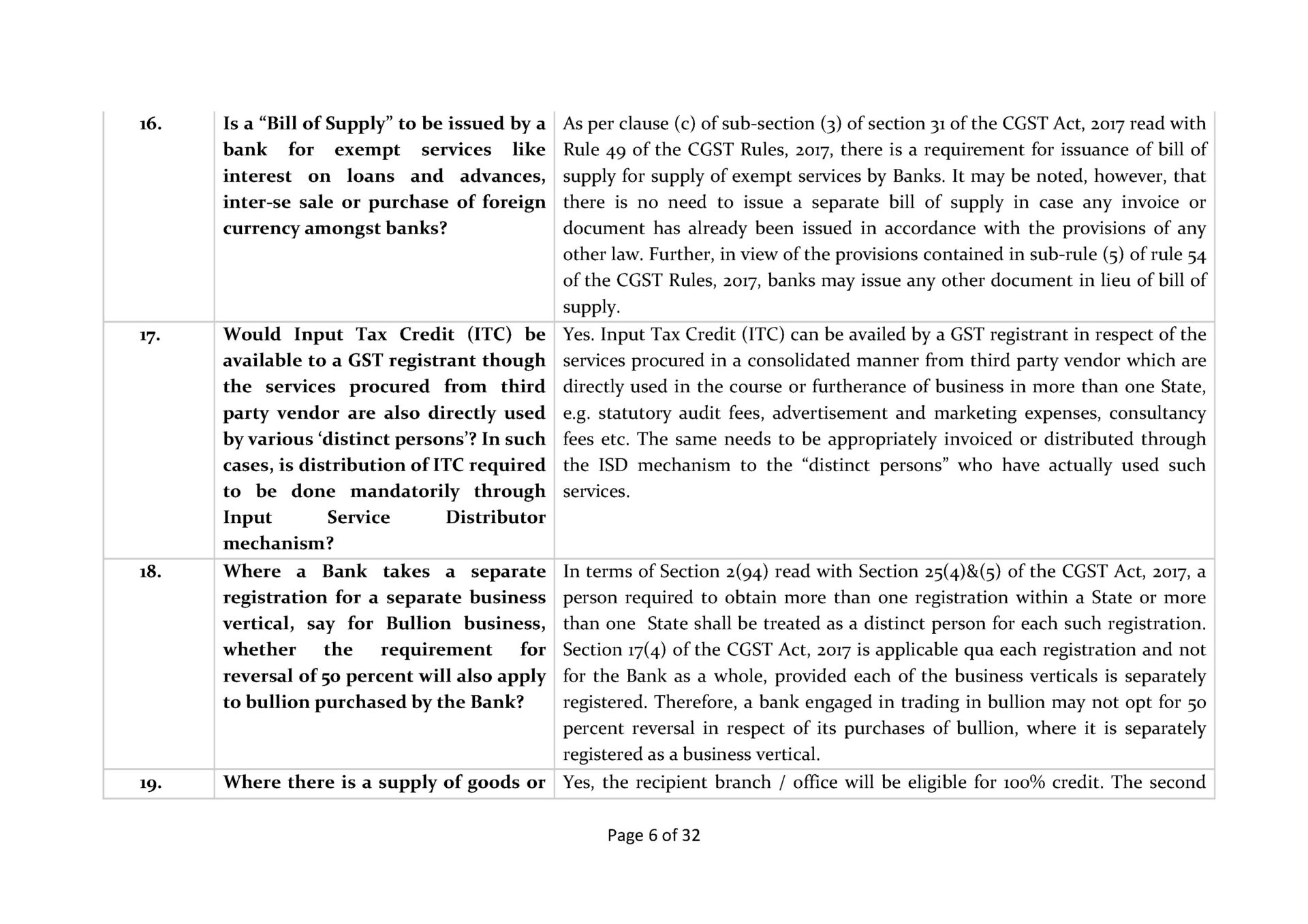

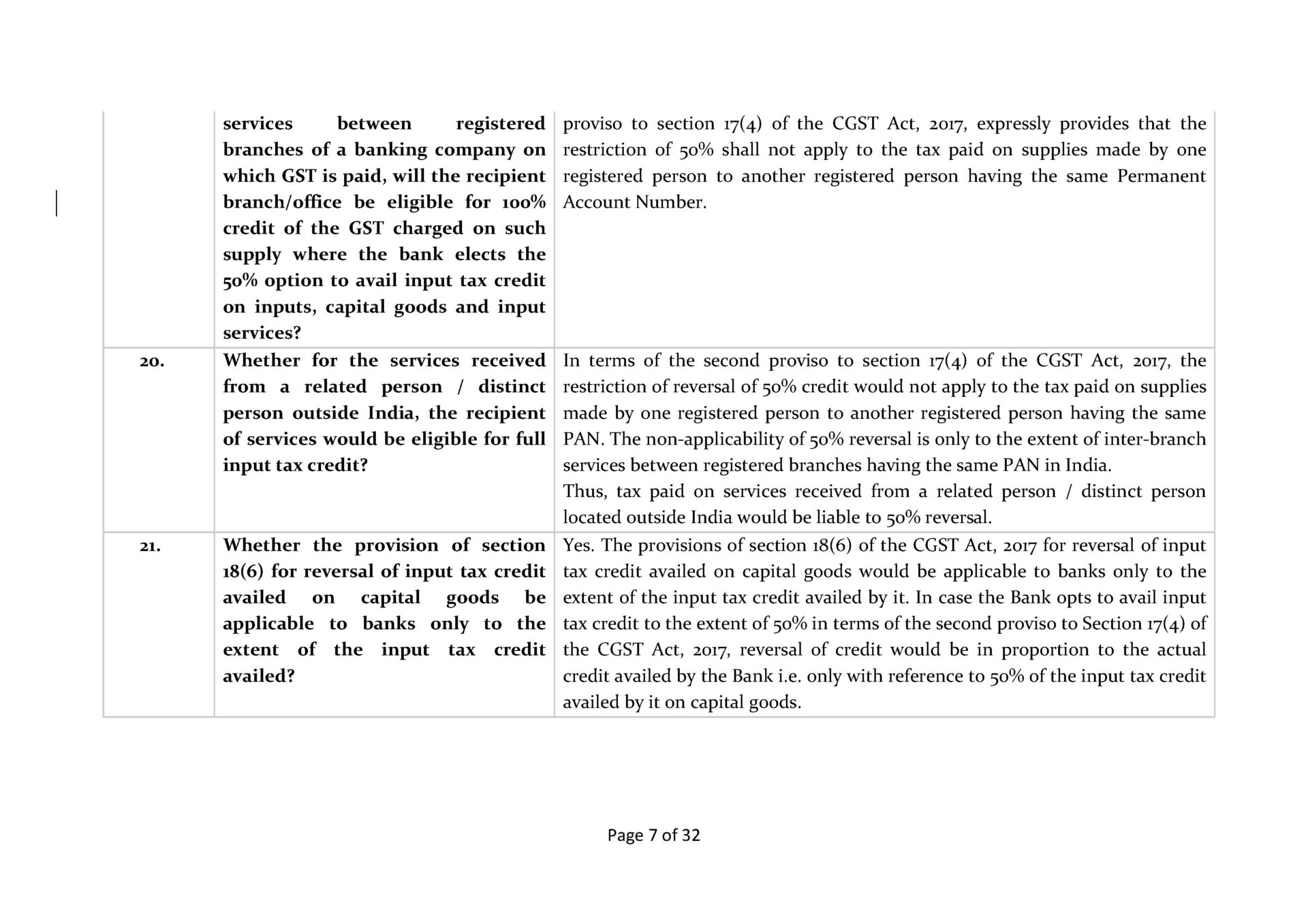

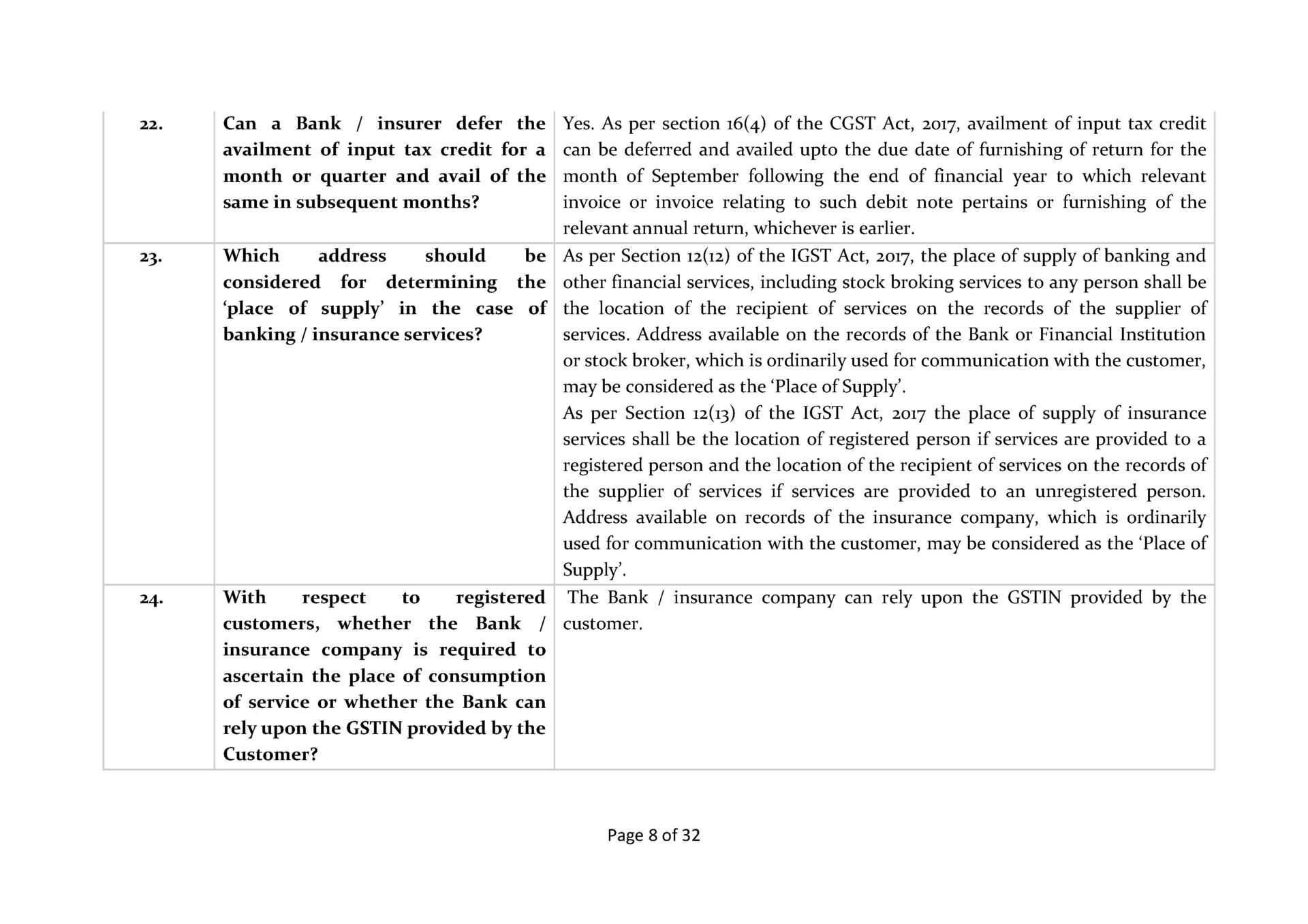

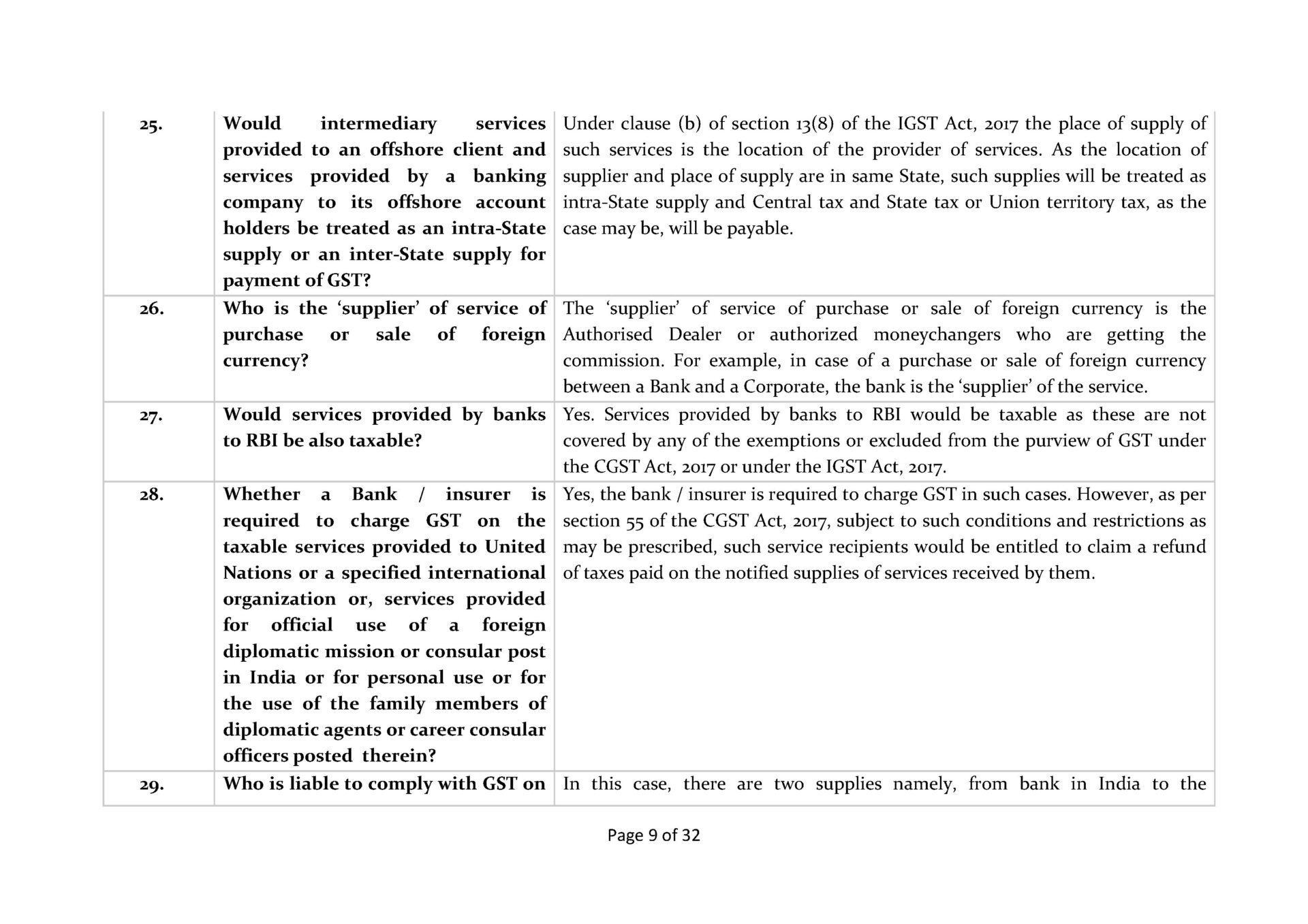

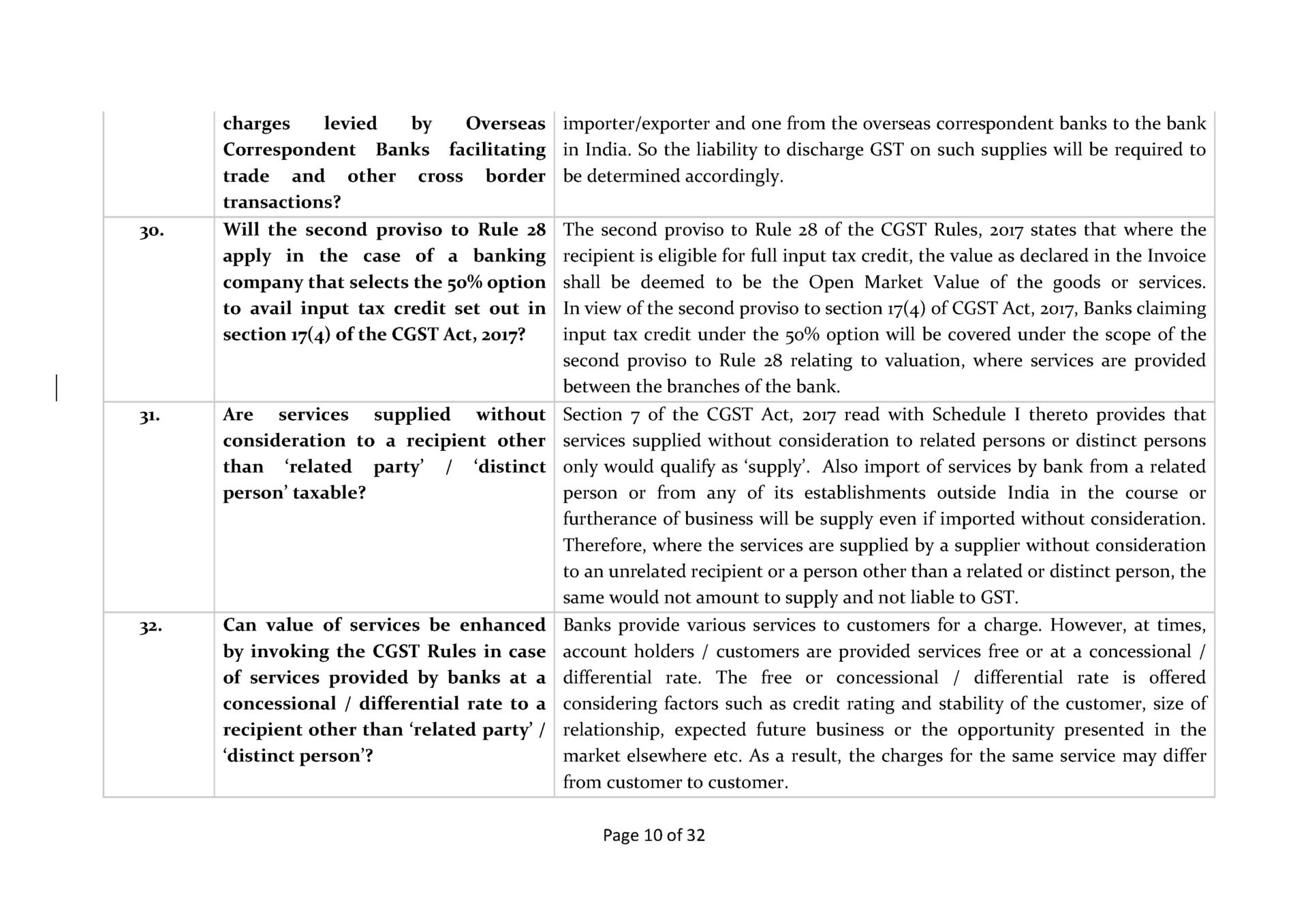

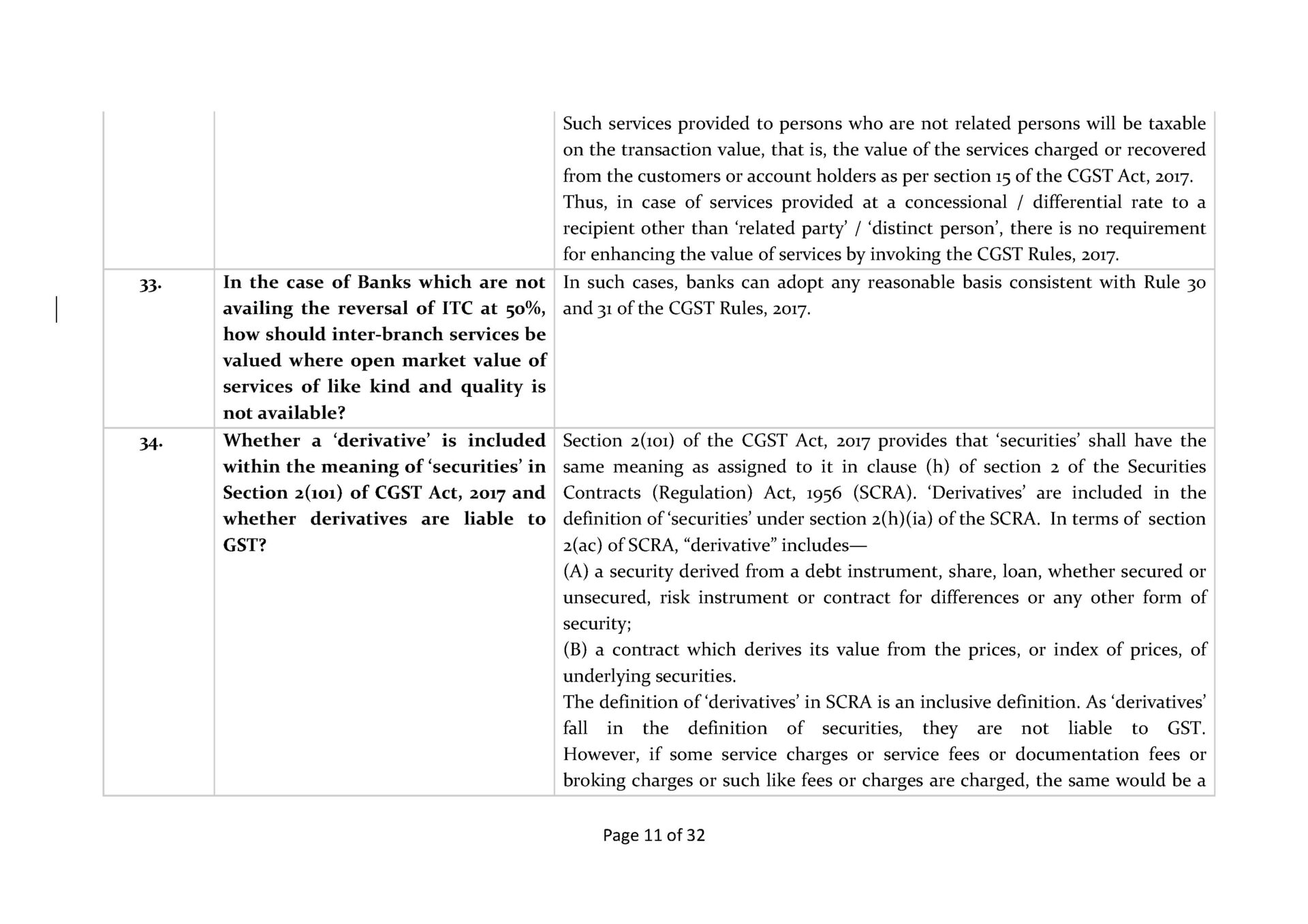

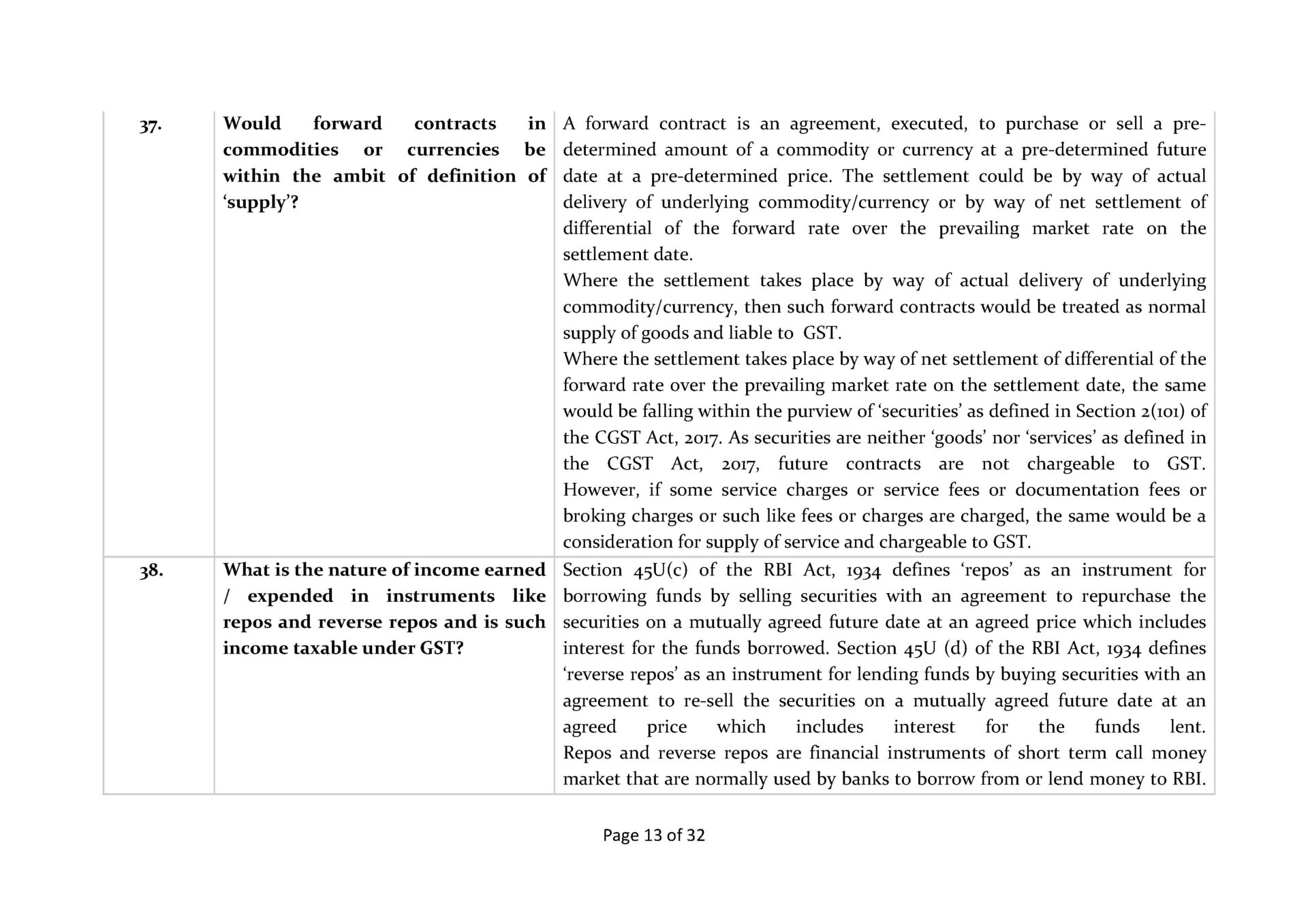

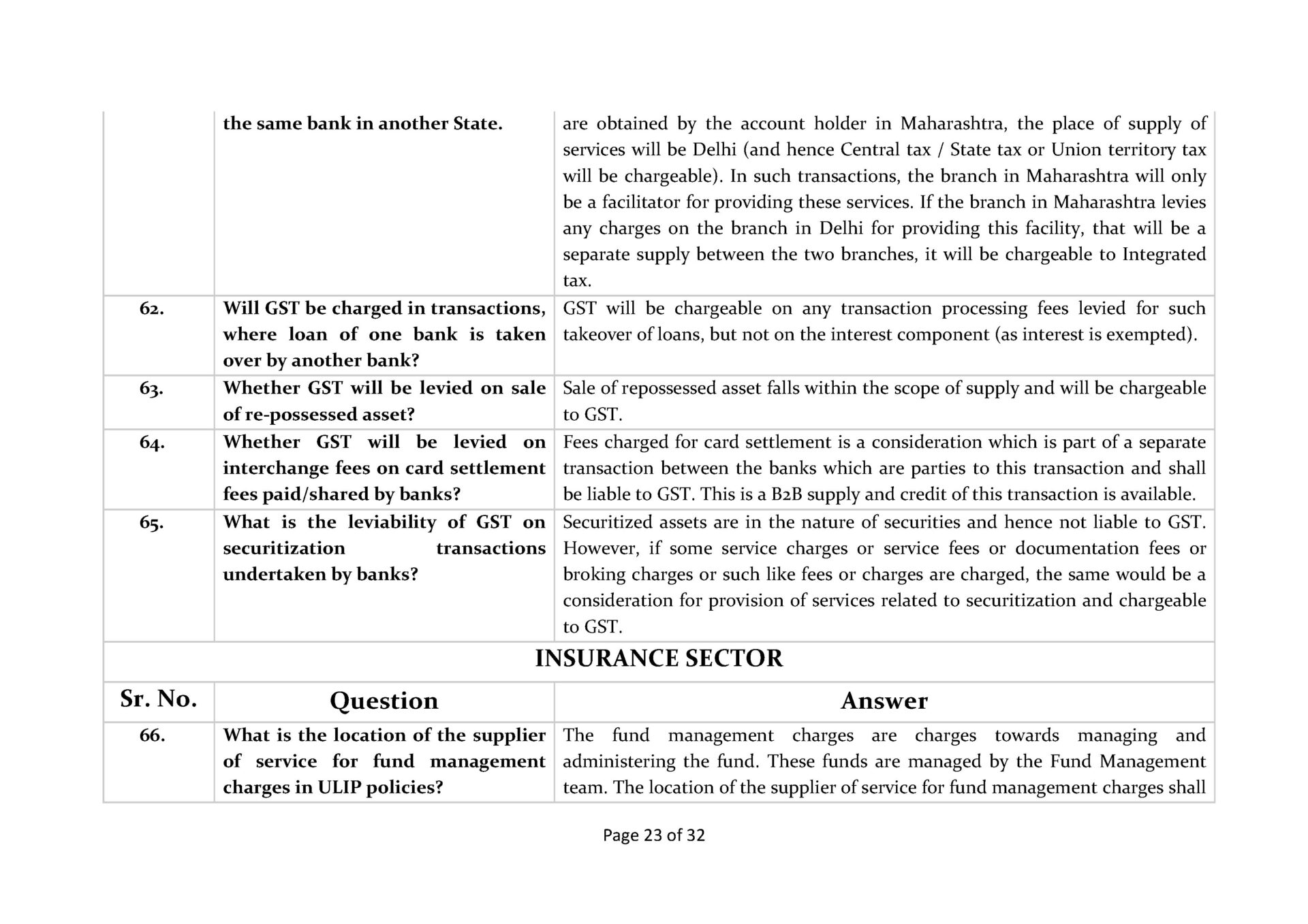

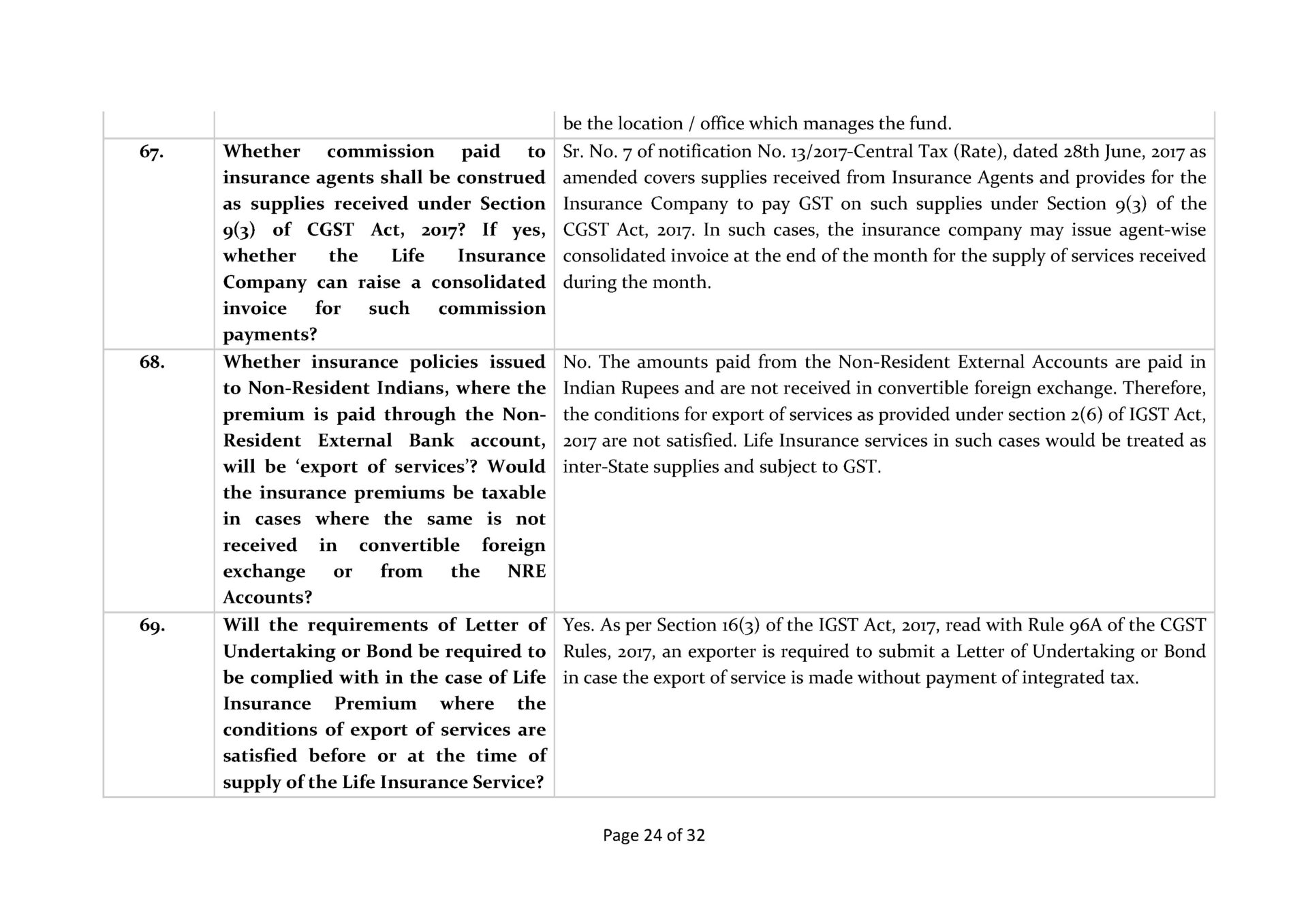

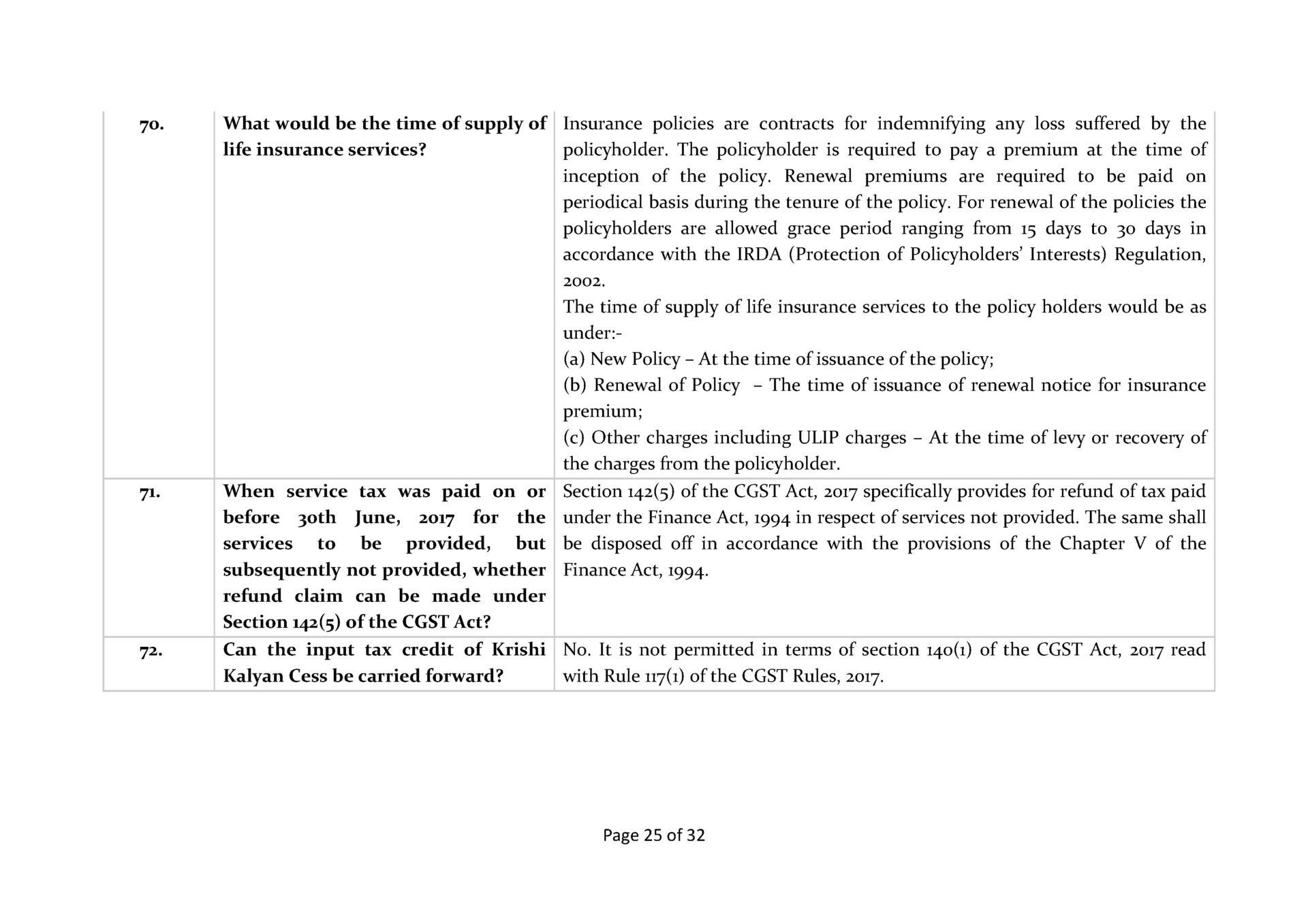

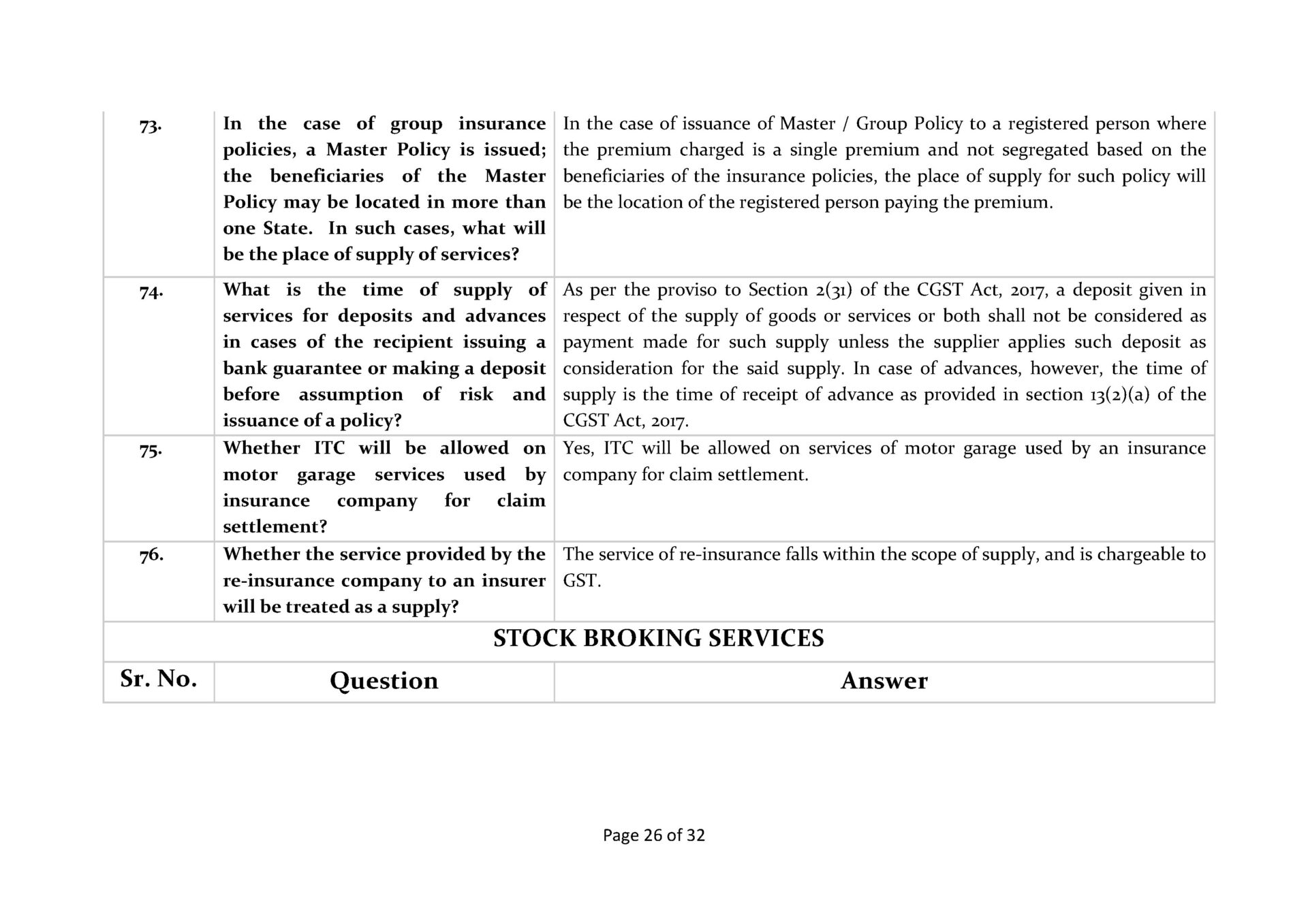

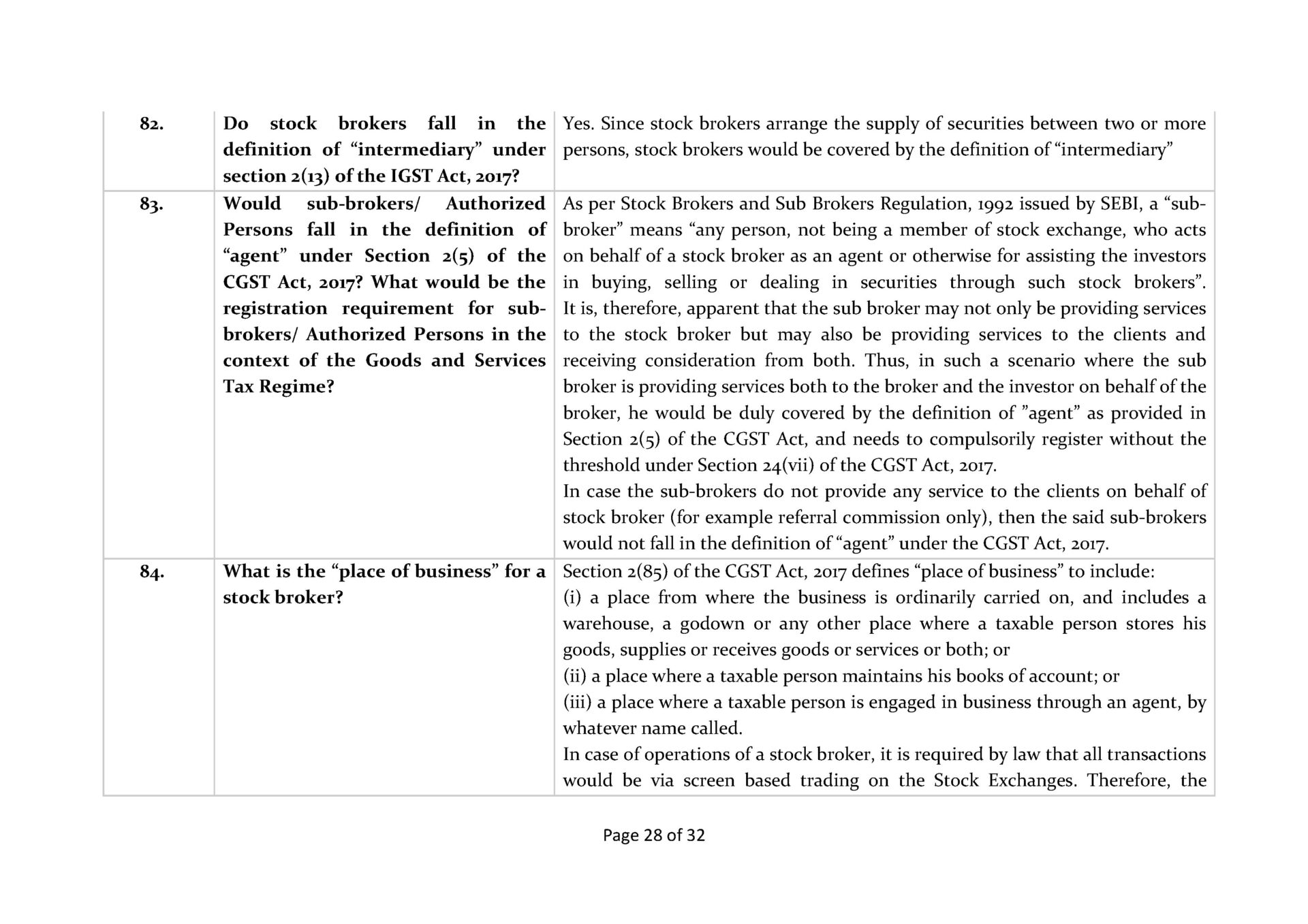

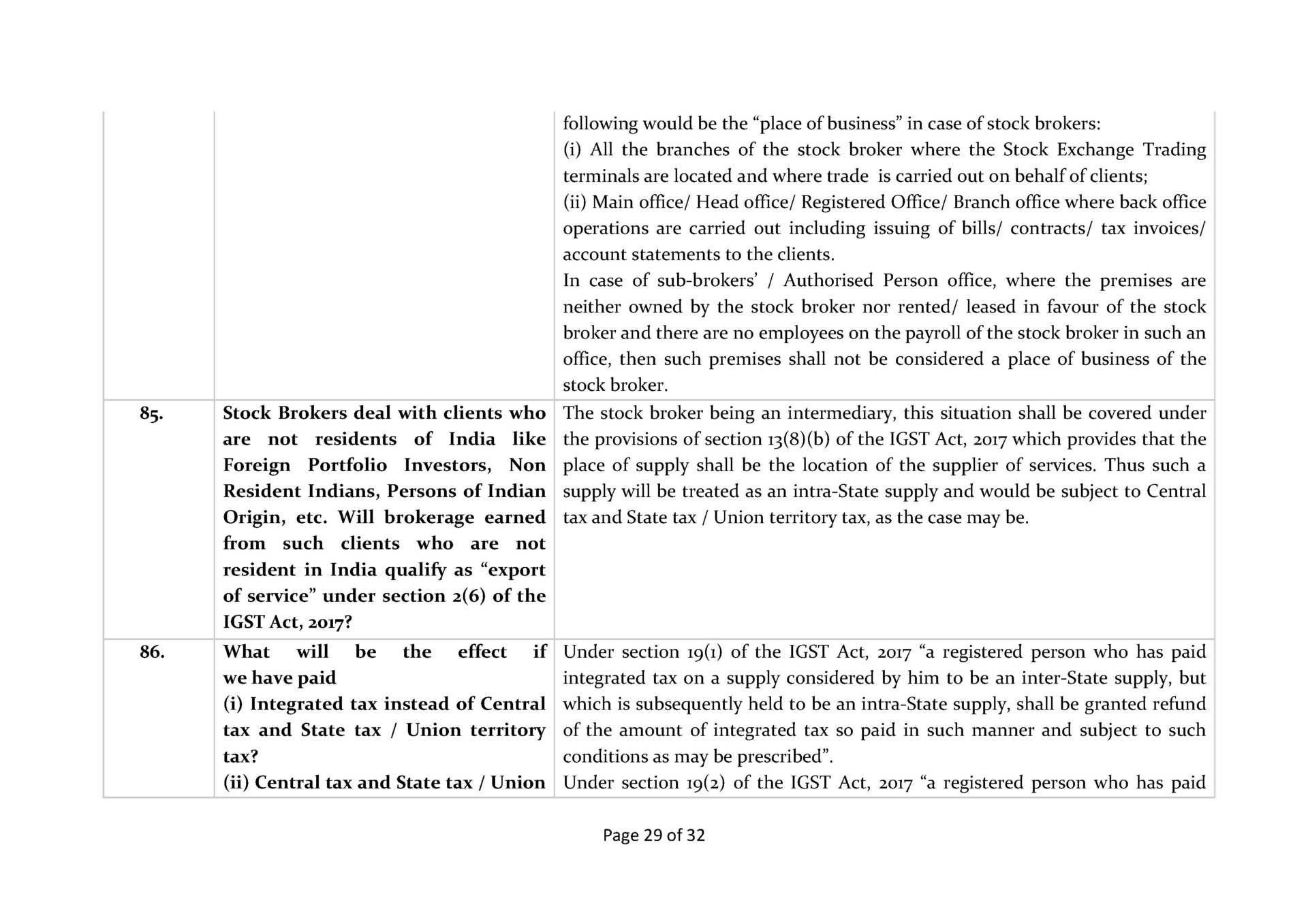

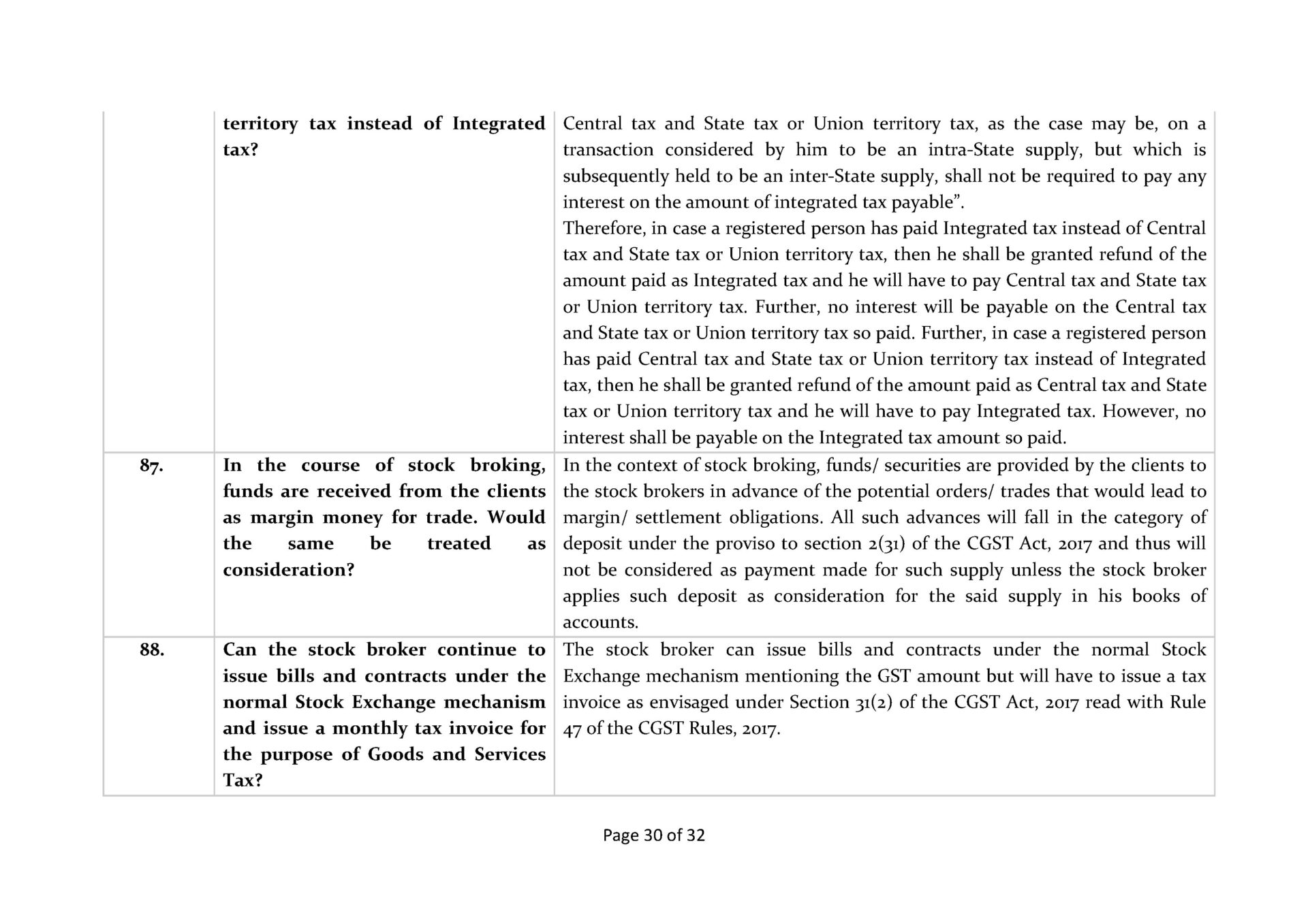

The following FAQs on Banking, Insurance and Stock broker sectors have been released by CBIC clarifying the position:-