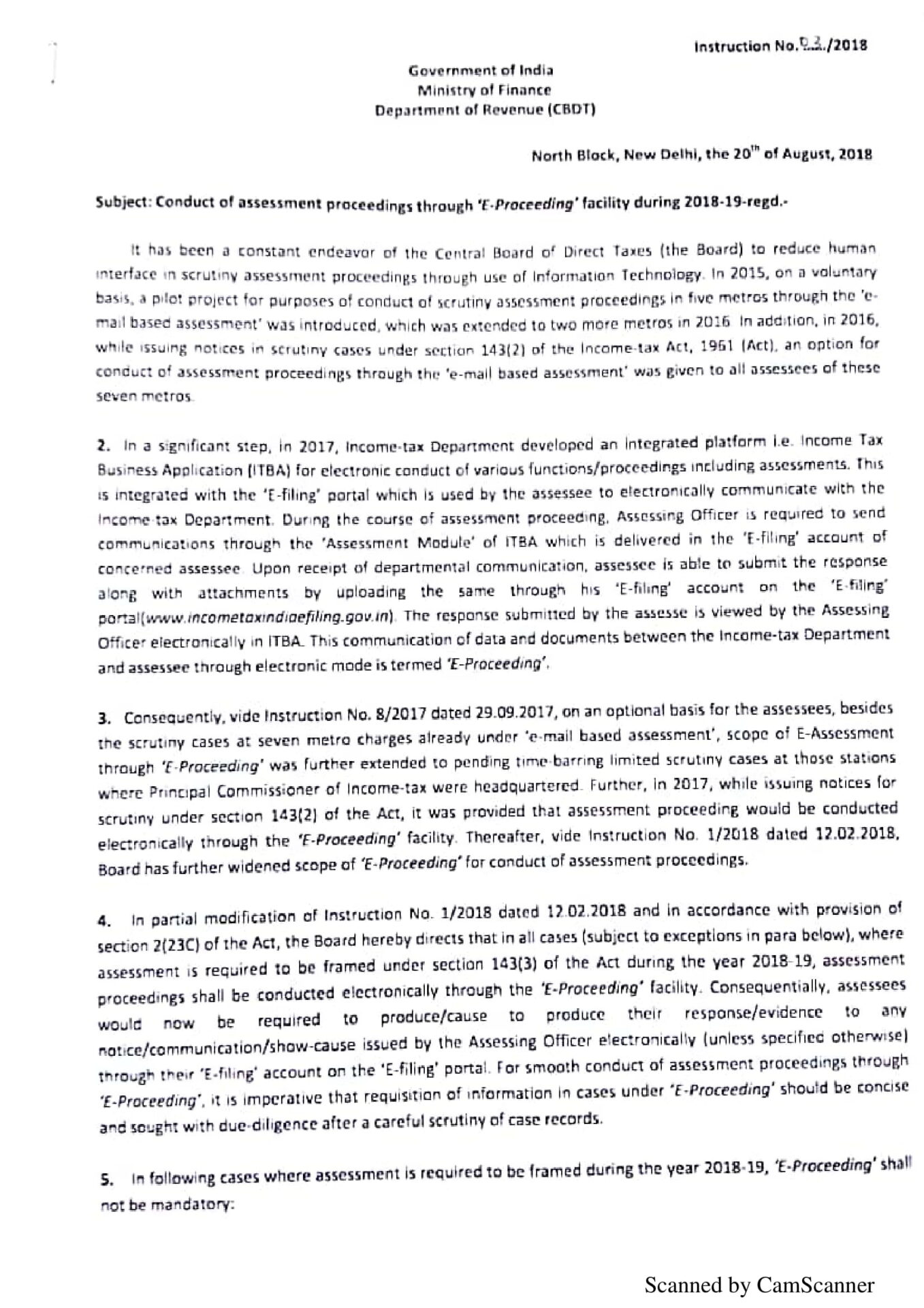

In the direction of paperless working in the income tax department, the CBDT vide its Instruction no. 03/2018 issues an instruction for conducting assessment proceedings through “E-Proceeding”facility during 2018-19. The Board directs that in all cases (subject ti exceptions mentioned below) assessment is required t be framed u/s 143(3) of the act during the year 2018-19, assessment proceeding shall be conducted electronically through the “E proceeding” facility. Further, it was also mentioned that for the purpose of “E Proceeding”, it is imperative that requisition of information in cases should be concise and sought with due-diligence after a careful scrutiny of case records.

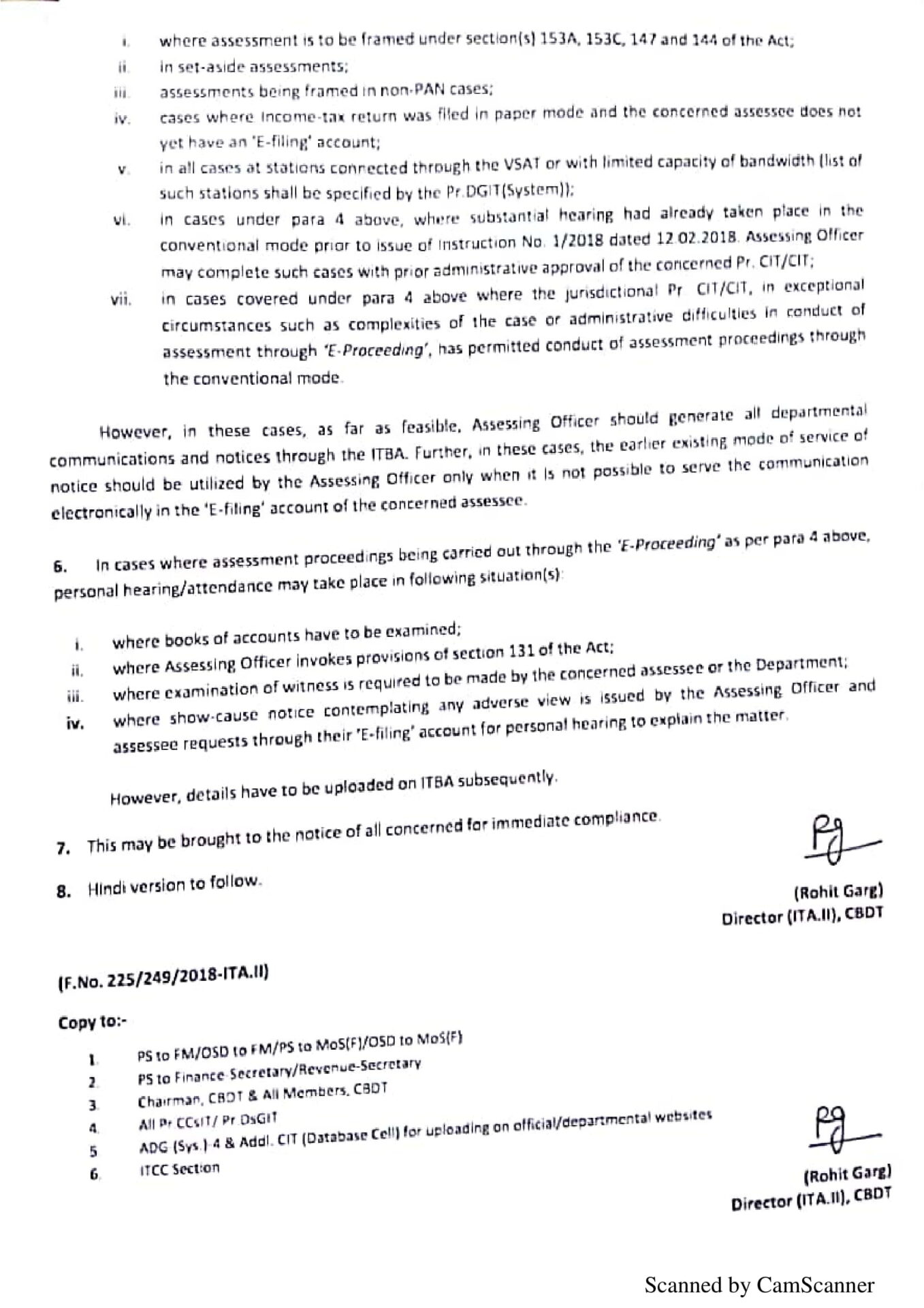

The CBDT excepts “E-Proceedings” in the following cases:

- where assessment is to be framed u/s 153A, 153C, 147 and 144 of the Act;

- in set aside assessments;

- assessments being framed in non PAN cases;

- cases where income tax returns was filed in paper mode and the concerned assessee does not yet have an “E Filing” portal;

- in all cases at sttaions connected through VSAT or with limited capacity of bandwidth;

- in cases where substantial hearing had already taken place in the convential mode prior to issue of the instruction;

- in cases where the jurisdictional Pr CIT/CIT, in exceptional circumstances such as complexities of the case has permitted conduct of assessment proceedings through conventional mode.

Below is the instruction no. 03/2018