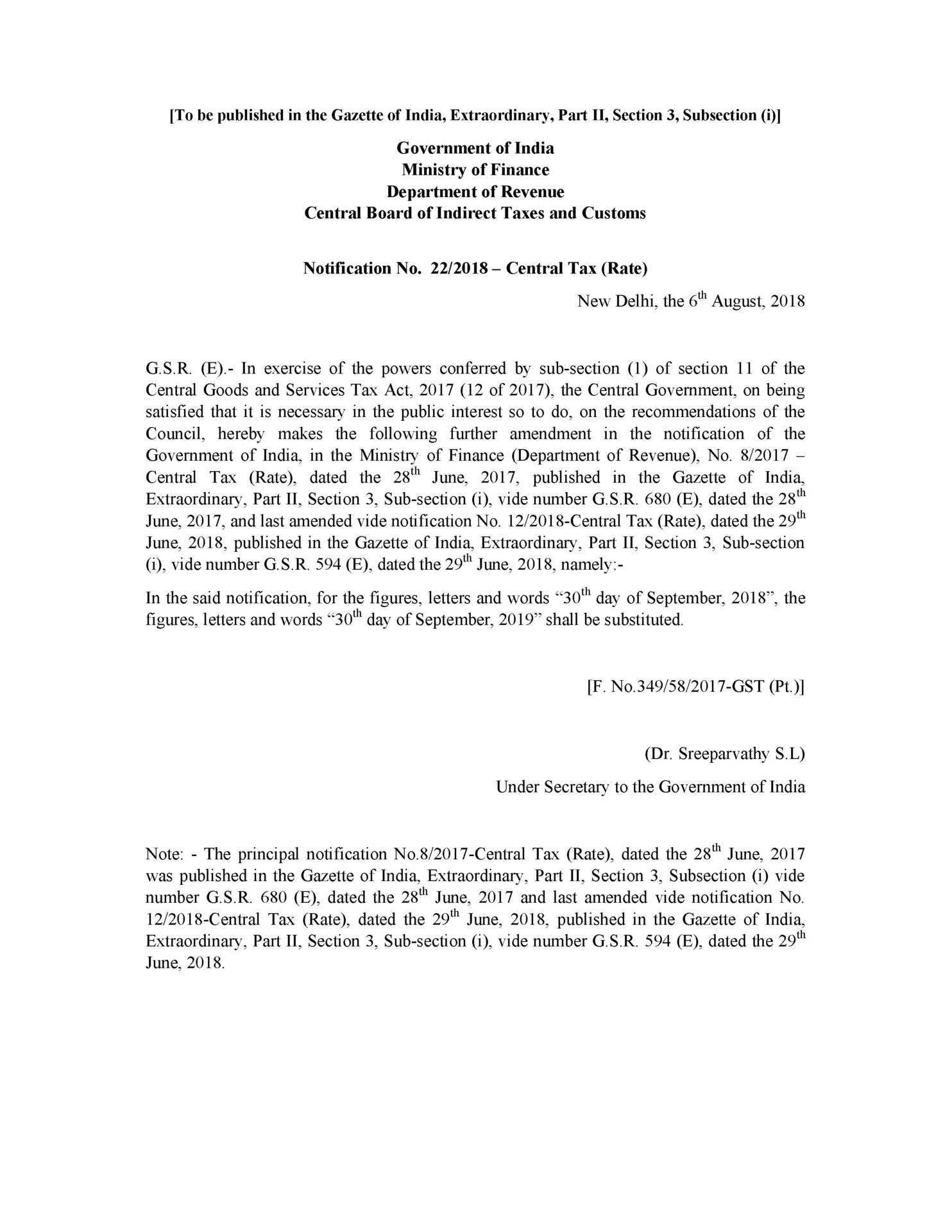

The Central Board of Indirect Taxes and Customs vide Notification No. 22/2018 – Central Tax (Rate) has postponed the applicability of Reverse Charge Mechanism (RCM) u/s. 9(4) from 30th September 2018 to 30th September 2019.

Click here to download the notification.